Search the Community

Showing results for tags 'surge'.

-

CNA Motorists taking bigger loans as COE prices surge SINGAPORE: As car prices rise, motorists in Singapore are chalking up bigger debt on their motor vehicle financing, according to latest figures released by Credit Bureau Singapore (CBS). The average loan quantum in July 2011 increased by 38 per cent, compared to the same period two years ago. Motorists now take loans with an average principal amount of $85,105, compared to $61,511 two years ago, and $74,399 a year ago. Despite the heavier debt commitment, delinquency rates for motor vehicle loans are on the decline. Only 2.49 per cent of car loan holders had an instalment that was overdue by more than 30 days in July 2011, compared to 2010's figure of 2.65 per cent, indicating that consumers are managing their payments well. William Lim, Executive Director of CBS, said the figures do not come as a surprise. He said: "It is unsurprising that loan quantum has surged given that COEs premiums, and consequently car prices have soared in the last two years. At the same time, premium cars have also overtaken mass market brands in sales, and luxury and sports cars have also hit new highs." CBS' data also show that as a result of high car prices, the demand for new motor vehicle loans continue to fall. From January to July this year, consumers took up 36,911 car loans, compared to 38,913 and 43,119 in the same period in 2010 and 2009, respectively - these include loans for new and second-hand cars. The CBS study also further revealed the effects of gender and age on motor vehicle loan trends. The age group of 40-44 borrowed the highest loan quantum, which stood at $99,411 in July 2011. Conversely, those aged 21-29 borrowed the lowest loan quantum of $57,857. Senior consumers above 54 years old bore the heaviest brunt of the steep increase in loan quantum, experiencing the highest increase of 53 per cent in their principle amounts in July 2011 compared to two years ago. Consumers aged 35-39 made up 19 per cent or almost one-fifth of new car loan holders, making them the top customer segment for these loans, according to the snapshot in July 2011. Young motorists exhibit the highest delinquency rate of 3.66 per cent, while consumers above 54 years old have the lowest delinquency rate of 2.02 per cent. CBS said the trend is consistent with other loan products. Male motorists tend to take bigger loans than female motorists. They also make up 75 per cent of new loan holders, outnumbering female loan holders by three to one. Lui Su Kian, Head of Deposits and Secured Lending, DBS Bank, said: "The average loan amount for car loans with DBS have increased by more than 10 per cent year-on-year. However, affordability remains healthy as customers seeking maximum financing have remained stable. "As we see more wealth being created in Asia, we have also observed that the financing of cars priced at more than $200,000 have doubled compared to 2010." CBS said it will continue to monitor the delinquency rate for motor vehicle loans, encouraging motorists to assess the affordability of their car loan carefully and practise responsible borrowing. - CNA /ls

-

COEs for all vehicle categories surge in latest bidding exercise By Mustafa Shafawi | Posted: 24 March 2010 1721 hrs Photos 1 of 1 SINGAPORE : COE premiums for vehicles across all categories surged in the latest bidding exercise that ended on Wednesday. The highest increase was in the Open category, where premiums jumped S$14,411 to S$42,001. COEs for big cars rose S$9,700 to S$36,089. Premiums for small cars jumped S$7,587 to S$28,389. COEs for commercial vehicles rose S$5,889 to S$32,890. Motorcycle COEs rose S$41 to S$1,200. This bidding exercise is the last under the current quota system. From next month, a new system to determine COE quotas will kick in. This will result in fewer COEs available monthly from April to July. - CNA/ms

-

Source: http://breaking.sg/story.php?title=surge-i...ontinental-cars

-

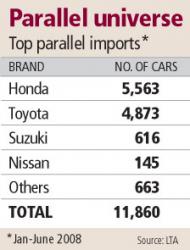

Business Times - 23 Jul 2008 Sales of grey imports continue to surge Nissan is now a key parallel import brand due to the iconic GT-R model By SAMUEL EE PARALLEL imports continued to power ahead in the first six months of this year, with 11,860 units registered, or 23.5 per cent of the 50,549 new cars registered in Singapore during that period - up from 2007's 20.9 per cent market share. The parallel import (PI) figure for the first half is contrasted against that of the 36,891 units by the Motor Traders Association of Singapore (MTA). MTA is a grouping of authorised distributors, although not all such distributors here are members. The ratio of PI to MTA sales is about 1:3 - the same as in Q1. This means that for every car sold by a parallel importer, three were sold by MTA members. Last year's ratio was 1:4. In the grey market, Honda currently holds sway, unlike Toyota in the authorised realm. Honda, Japan's No. 2 car maker, accounts for 46.9 per cent of all new parallel imports sold between January and June 2008, while Toyota, the world's biggest car maker, makes up 41.1 per cent. Together, Honda and Toyota constitute 88 per cent of all first-half parallel imports. The pace of Q2 sales has not slowed down compared with Q1. In fact, Q2's volume is slightly higher than Q1's. One interesting feature of H1 2008 is that the Nissan brand is suddenly a PI favourite with 145 units sold during this period, compared with just 27 grey imports for the whole of 2007. This is mainly due to the overwhelming popularity of the high-performance Nissan GT-R sports car (88 units in H1 2008) and the compact Dualis SUV (37 units). The first GT-R arrived here in January as a grey import and it will only be available from authorised Nissan distributor Tan Chong Motor Sales sometime in the second quarter of 2009. The four Japanese brands combined - Honda, Toyota, Suzuki and Nissan - account for a whopping 94.4 per cent of all PI year-to-date sales. Among PI models, the most popular is the Honda Fit with 2,058 units. This diminutive five-door hatchback arrived here last November while the Jazz, the export version from authorised distributor Kah Motor, will only be ready for registration nearer year-end. The Stream compact MPV is No. 2 with 1,865 units, while No. 3 is the domestic Japanese version of the ever popular Toyota Corolla, called the Axio (1,406 units). Also noteworthy is the number of Mercedes-Benz cars - 142 units in the first six months versus 236 for 2007 - a fact that can be attributed largely to the new C-Class model (43.7 per cent of total Merc registrations).

-

Toyota remains the market leader in Singapore By SAMUEL EE HONDA is racing ahead in the sales stakes and is now in the No 2 spot among members of the Motor Traders Association of Singapore (MTA), after claiming the No 3 position just last year. Toyota is still Singapore's most popular make among MTA members after the first nine months of 2007 - a position it has been enjoying since 2002. From January to September, authorised distributor Borneo Motors sold a total of 13,822 Toyota or Lexus cars. Lexus is the luxury division of Japan's biggest car maker. But today, Toyota is looking at a very different competitor just below it. Where Nissan used to reside as the runner-up for five consecutive years, Honda is now comfortably ensconced. In the first nine months of this year, authorised distributor Kah Motor registered 8,567 cars. Nissan, on the other hand, had 7,850 units in the same period. Nissan, which had been runner-up to the Toyota juggernaut for five consecutive years, was overtaken by Honda in early August. This is the second time in two years that Honda has surged ahead in the MTA rankings. In July 2006, it overtook Hyundai for the No 3 spot and ended the year by finishing in the top three, after Toyota and Nissan. In 2006, the top three makes were Toyota, Nissan and Honda, in that order. Last year's all-Japanese line-up was achieved after Honda edged out Hyundai from its traditional third place. For 2007, it looks like Team Japan will make a further improvement by sweeping the top four positions because the current No 4 spot is occupied by Mitsubishi, which sold 6,544 cars. It has displaced Hyundai, which has fallen to No 5 with just 4,515 cars sold. Even if its 1,778 Sonata taxis are included, Hyundai's grand total of 6,293 is not enough to beat Mitsubishi. The traditional price advantage which Hyundai models used to enjoy has been eroded by a move upmarket as well as the stronger Korean won. These factors allowed entry-level Japanese alternatives like the Nissan Sunny and Mitsubishi Lancer to race ahead on the weaker Japanese yen. Not unexpectedly, Honda and Mitsubishi were among those makes which also posted an increase in market share among MTA members. Honda's year-to-date market share of 13.5 per cent is a 2.6 per cent improvement over the same period last year, while Mitsubishi's 10.3 per cent market share is 1.6 per cent higher. An estimated 63,600 cars were sold by MTA members from January to September. Toyota's market share continues to slip but the juggernaut's huge base means it is in no danger of losing its market leader status. For the first nine months of 2007, it had a market share of 21.7 per cent, down 3.8 per cent over the same period in 2006. This means that about one out of every five cars sold by MTA members is either a Toyota or Lexus. But compared to four years ago, this proportion is down from what used to be almost three out of every 10 new cars. Just last year, Toyota accounted for 25 per cent of the 98,699 units sold among MTA members. An ageing model line-up and aggressive marketing by parallel importers are among the reasons for its diminishing volumes. This is MTA figure

-

PRAGUE : Skoda Auto, a subsidiary of the German Volkswagen group and the biggest car producer in the Czech Republic, reported an 18.5-percent surge in first quarter sales. Skoda said that sales had totalled 129,778 vehicles, a rise of 18.5 percent on a 12-month comparison. Sales increased across the board for all three models compared with figures for the first quarter of 2005, the company added. Sales of the bottom-of-the-range Fabia climbed by 7.2 percent, of the mid-range Octavia by 31.7 percent and of the top of the range Superb by 14.7 percent, it added. "Skoda Auto is therefore heading for record full year sales," the company said. Sales increased in all key markets compared with figures 12 months earlier, Skoda Auto said. In Western Europe sales rose by 17.9 percent with 74,723 vehicles sold. In central and eastern Europe the rise was 10.8 percent to 44,181 vehicles. In Asia, Africa and other overseas markets, sales rose by 73.8 percent to 10,874 vehicles. - AFP /ct http://www.channelnewsasia.com/stories/afp.../202502/1/.html

-

Hi bros, I've this prob with my aveo5 mt, I've been experiencing a slight power surge when i accelerate in 3rd gear. I've always been changing gears at 2k rpm... Help