Search the Community

Showing results for tags 'savings'.

-

Let's start with this https://www.straitstimes.com/singapore/courts-crime/ocbc-bank-customer-lost-120k-in-fake-text-message-scam-another-had-250k-stolen Young couple lost $120k in fake text message scam targeting OCBC Bank customers SINGAPORE - It took a man and his wife five years to save about $120,000, but in just 30 minutes, scammers using a fake text message stole the money they had kept in their OCBC Bank joint savings account. The couple in their 20s were among at least 469 people who reportedly fell victim to phishing scams involving OCBC in the last two weeks of December last year. The victims lost around $8.5 million in total. The husband works in the e-commerce sector, while his wife is in the hospitality industry. The man said he received the phishing message with a link at around noon on Dec 21 last year. A 38-year-old software engineer who fell prey to the same scam on Dec 28 told ST that he lost about $250,000 he had been saving since 2010. The father of a young child with special needs said the loss has been devastating, and he has been hiding it from his family. The bank said it has since halted its plans to phase out physical hardware tokens by the end of March this year, and has also stopped sending SMSes with links in them in the light of the spate of phishing incidents. Cyber security expert Anthony Lim, who is also a fellow at the Singapore University of Social Sciences, said scammers have advanced software enabling them to spoof telecommunications services and send SMSes that appear in the same threads used by real organisations. He added that even if victims did not provide their one-time passwords (OTPs), they would have sealed their fate when they entered other bank details on the fraudulent sites. "Once the victim unwittingly responds by entering the bank account credentials, the hackers' technologies can divert and capture a copy of the SMS OTP issued by the bank," he said.

-

Talking Point >>> Is your CPF enough for retirement?

Jellandross replied to Wt_know's topic in Investment & Financial Matters

Rich but poor 😰 High income doesn't guarantee savings: A bank director earning $88,000 monthly had only $13,000 savings due to $46,000 personal and $30,000 family expenses. His own monthly expenses would come to about $46,000 on average, while his former wife said she and their two children, aged 20 and 18, would need more than $30,000 every month. That meant that almost 90 per cent of his monthly salary would be spent on their expenses alone. Despite a $2.9 million home, the director took extra mortgages and credit card loans to cover expenses. -

DM LED HEAD LIGHTS ================== 2500 lumens LED Headlights ( lastest technology ) energy savings and white light projection. Non heat emission and will not damage headlamp appearance unlike HID. LED Open for bookings now. Message or call us at 6341 6164 to enquire.

- 5 replies

-

- head lights

- headlights

-

(and 6 more)

Tagged with:

-

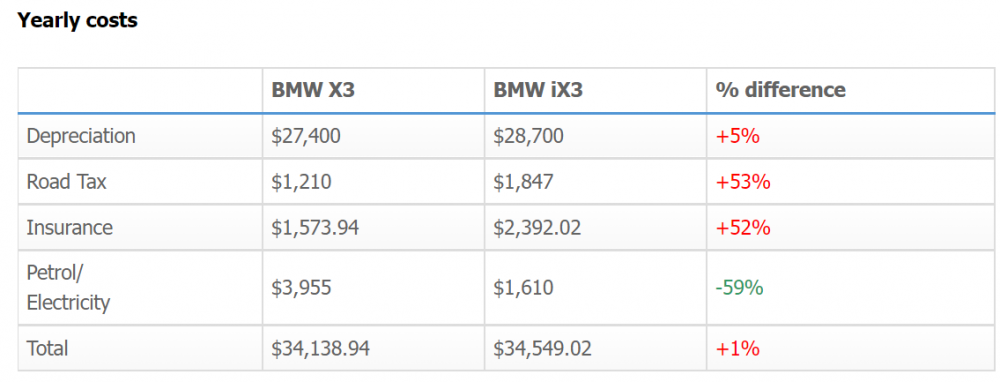

There's been so much going on about how EVs are the future and how EVs are cheaper to run than ICE cars because of the low maintenance cost - technically the only maintenance for an EV would be your tyres, brakes, fluids, battery and wiper blades lol - and how electricity (per km) is cheaper than fuel (per km). Our colleague Desmond takes the BMW X3 and its electric counterpart the iX3, for an apple-to-apple comparison to figure out if it's really cheaper to go electric. Copied the table above from the article just for those who are lazy to click in but it's an interesting read so click here if you can afford the 5 minutes read. Some might also argue there are intangible costs not mentioned in the article e.g. time and inconvenience costs while waiting for your EV to charge up. EV owners will be asking everyone to look at the bigger picture - not so much about cost savings but doing our collective part to reduce emissions and help fight global climate change. The current electric cars in the market are much more expensive than ICE cars and will probably put off most car buyers from switching over (at least for now), but the early adopters will be key to driving technological advancement and improvements. What do you think? Do you see yourself changing to an EV in the next 5 to 10 years?

- 89 replies

-

- 2

-

-

- electric car

- savings

-

(and 3 more)

Tagged with:

-

We have a food crisis upon us, a war in the north, countries restricting exports, fuels prices climbing new highs constantly and our property prices still going up and up.. There seems to be a constant pressure on us to conserve, spend less or worse stop living well. This is MCF, and whilst everyone is affected, being drivers, we aren't in the lowest echelons of the society, and are more likely to be in the middle, but it also means we are sandwiched between enjoying our current lifestyle and trying to pay all the bills on time, without resorted to more loans, defaults and compromises that have dire consequences. So maybe we can get real tips from bros on how to lean burn with dignity, whilst keeping the bellies full and yet live fulfilling lives and encourage one another. So please share, not merely make fun, but do share how to make it work and get out out the crisis well both physically and mentally, even spiritually. - our finances are like an input output chart.. INPUT: - we can try to earn more, but that can be hard in the middle of a crisis -- eg changing to a higher paying job if we get a chance -- get more / better returns for our investments -- get alternate revenue streams OUTPUT: - here there are more choices that bros can share... -- cut down on overseas trips or switch to a cheaper holiday destination, eg Asia-Pac holiday instead of Europe and a shorter duration -- using cheaper fuels -- household brands -- eat good food, but eat at less expensive venues -- cook at home more -- watch movies at home instead of in the cinemas -- keep healthy to save on medical bills, -- exercise more and enjoy the outdoors, pretend it's a trip and camp locally or just take a tour around SG -- use free resources like the library - did you know they have DVDs? -- use free online streaming, legal ones eg Viu, Mewatch -- buy one movie and watch with your buddies together -- take up free hobbies -- help someone else who is in need more - this may cost you time and money, but it can be cathartic, and be good for your mind and soul I heard some friends who are really stressed about the current times, and maybe it's time we can share ideas on how to overcomes things. Not everyone is equally affected, and some may be thriving in these times, but lets encourage and be a pillar and friend to others in these times... Hope others can share too

- 180 replies

-

- 16

-

-

As above .. Gurus here any comments on this offering? 6% PA for the next 4 yrs seems good lei.. TIA..

-

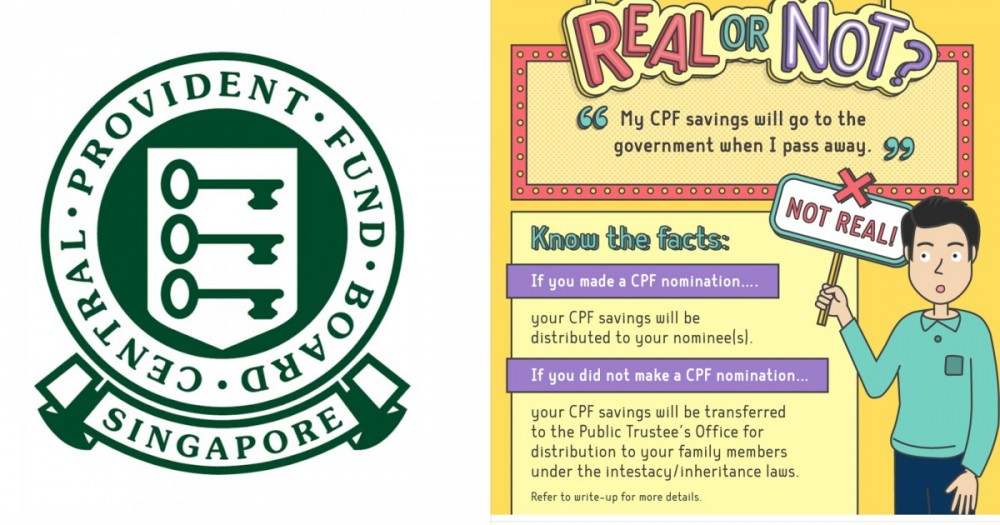

https://www.channelnewsasia.com/news/asia/malaysia-epf-withdrawal-anwar-najib-relieved-prudent-13602184 I read this news with great interest.. We have some Singaporeans clamouring for their early withdrawal of the SG equivalent: CPF. Now that a neighbouring country which literally took our system and implemented it in their own nation is allowing this, we can see how prudent this will be. Can we really manage our own funds if we get a large windfall? Now we aren't talking about armchair intellectuals here.. we are talking about the masses, who may not deal with large sums of money on a regular basis, and may rush headlong into unwise investments or get forced into giving it to their kids.. So this will be an interesting study of whether it's a good idea or not IMO. https://www.thestar.com.my/opinion/columnists/the-star-says/2020/11/08/epf-account-1-withdrawals-welcomed---but-must-be-treated-cautiously Already words of caution are sounding out..

-

Members of the public are advised to make nominations for their central provident fund (CPF) monies as early as possible, after CPF monies left unclaimed with the Insolvency and Public Trustee’s Office over the last six years reached a total of S$211 million. The Straits Times reported that the bulk of these unclaimed monies belonged to dead people who did not nominate anyone to receive their CPF funds. According to the Ministry of Finance, the monies are said to be unclaimed if owners are uncontactable after repeated attempts by the agencies to do so. All valid claims will be repaid, regardless of how long the monies have been held. According to the Ministry of Finance and the Ministry of Law, about S$240 million in unclaimed monies was left with the government over the last six years https://mothership.sg/2019/10/nominate-benefactor-early-unclaimed-cpf-money-211-million/

-

The CPF salary ceiling, the maximum amount of ordinary wages that employee and employer contributions are calculated on, was raised from $5,000 to $6,000. "Middle-income Singaporeans will be able to accumulate more CPF savings during their working years," Deputy Prime Minister Tharman Shanmugaratnam said when he announced the latest change during the Budget in February last year. At least 544,000 CPF members are expected to benefit. - See more at: http://news.asiaone.com/news/business/more-cpf-savings-new-rules#sthash.pajiY2Zl.dpuf ==== 1. There are 544,000 people earning $5000 or more here. Excluding sole proprietors, directors and private tutors. 2. Each person (and employer) will pay $370 more monthly. Gov will receive >$200mil cash monthly. Or gov really short of cash meh? 3. $370 more in the CPF account. About $200+ can be used for housing loan. Positive impact to the property price. 4. $200 less take home pay.... Retail business and COE.... down down down. 5. Boss will tell us... "You already got $170 increase in your CPF. No increment this year." Are we really richer? The ChengHu is for sure.

- 275 replies

-

- 15

-

-

For those who dislike risky investments and wished money can grow more: http://www.straitstimes.com/business/invest/singapore-savings-bonds-rolled-out-for-first-issue Singapore Savings Bonds rolled out for first issue The MAS is set to issue between $2 billion and $4 billion of SSBs this year across three planned issuances.ST PHOTO: KUA CHEE SIONG PUBLISHED2 HOURS AGO Wong Wei Han SINGAPORE - The Monetary Authority of Singapore (MAS) rolled out the first issue of Singapore Savings Bond (SSBs) on Tuesday (Sept 1), promising a 2.63 per cent average annual return if they are held for 10 years. The interest rate - or rate of return - of the first issue SSBs will start at 0.96 per cent for the first year, data released by the MAS showed. The rate will then go up to 1.09 per cent for those holding the bonds into the second year, which translates to an average annual return of 1.02 per cent. For the third year, the rate of return will be 1.93 per cent, which means an average annual return of 1.32 per cent. Thereafter, the rate will go up to 3.7 per cent for the tenth year, when the average annual return hits 2.63 per cent. This reflects the "step up" feature of the 10-year bonds, which ensures gradually increasing returns for those who hold the bonds longer. A total of $1.2 billion of SSBs will be issued for this first tranche, which will be open for application between 6pm on Tuesday and 9pm on Sept 25. Interested investors must have an Individual Central Depository (CDP) securities account complete with Direct Crediting Service. They can then apply through the ATMs of DBS, POSB, OCBC and UOB, or through internet banking services of DBS and POSB. The SSBs can be applied in multiples of $500, up to a maximum $50,000 for a single issue. Returns will be paid out twice yearly - on April 1 and Oct 1 - for as long as the bonds are held. "SSBs are allotted after all applications have been collected in a way that distributes the available bonds as evenly as possible to maximise the number of successful applicants. This means that if a Savings Bond is over-subscribed, investors who applied for larger amounts may not get the full amount they applied for," MAS said, adding that the allotment results of the first issue will be announced on Sept 28. Related Story Singapore Savings Bonds: What you should know First announced in March, the SSBs have drawn investors' attention for their flexibility and security. Unlike the regular bonds, the SSBs still offer accrued return to investors who wish to redeem the bonds ahead of the full 10-year tenor. The investment is also capital guaranteed, and is backed by the Singapore government. The MAS is set to issue between $2 billion and $4 billion of SSBs this year across three planned issuances. It is also committed to issue every month for at least the next five years.

- 4 replies

-

- singapore savings

- bond

-

(and 2 more)

Tagged with:

-

Hi all this is an old topic which i am trying to approach from a slightly different angle. How long can SGD1mio last a household based on the following assumptions; 1) Household consists of husband and wife with a teenager in local Uni (final year) 2) The teenager son/daughter cannot be depended on for any income source and is infact a current liability untill he/she is financially independent. 3) Both husband and wife have reached mandatory retirement age 4) All houselhold loans and liabilities have been paid off. The house, car etc have all been paid off 5) The household has no other source of income other than their cash savings of SGD1mio 6) Assume null balance in CPF. No value is given to money that you cant see smell or touch. 7) Everyone is in normal health with no big health issues for now. 8) The household has a japanese sedan (Toyota) 1.6l which has 5years COE left 9) The family intends to retire and live here in Singapore Based on the above, if they want to maintain their current lifestyle can they retire now and live on SGD1mio cash? How long will this last them? We had this talk with some colleagues over lunch and the estimates were quite surprising.

- 246 replies

-

Straits Times Published an article showing that it is possible to save $100k with roughly 6 years of work. The key thing is You have to save at least 50% of your annual pay You got to live within your means and make sacrifices What I felt it misses out are Young adults have many other liabilities that make it practically hard to achieve this Housing, Wedding, Honey Moon, Student Loans Hence the need for sacrifices! How I did it I did a check on my Quicken (see another good reason to do budgeting!) and it showed that I was able to achieve that amount by 30. In fact seems a lot of folks can judging from what you read around. Then again I probably fit the profile of what this experiment did Single Cheap Hobbies Some sacrifices Near 50% saving rate I think I have it much harder since for 3 out of the 6 years my salary was less than the median salary provided. One note is that I only consider the amount that goes into Wealth Building Account as what the article considered. Other saving goals probably out of the equation. Some kids are even more absurd I know many smart young adults nowadays that are sensible enough to do one or more of the following Scholarships (study well!) Start working part time and accumulate Tuition and accumulate NS pay accumulate Start learning about money Some crazy dudes I know with that combination, will have $100k before he starts work at 25 years old. Why does this matter? If you would want to grow wealth By spending less building wealth Leaving more of your salary for escalating expenses You got to let time value of money help you. Here are 2 guys. One guy saves $1k per month from 25 to 35 years old then stops. The other guy starts late and only starts saving from 35 to 65 years old (30 years) At the end of the day, the guy that save for 10 years only uses 120k while the guy that starts late uses 3 times the amount. The difference is the guy starts late only manages to come out 40k ahead. Have a plan when you start working I can understand why folks had a hard time because some things weren’t taught in school but in life (sadly) If you managed to come across this article then hope this helps Its good to have a map that provides you a map how you want to spend your money. If you don’t have you can use the following as a guide. Start Thinking how much to funnel to savings and wealth building http://www.investmentmoats.com/budgeting/saving-100k-by-the-time-you-are-30-years-old/

- 226 replies

-

- 3

-

-

- investment

- savings

-

(and 4 more)

Tagged with:

-

An article that contradict many 'established' tips . What do you think? http://finance.yahoo.com/family-home/artic...eries-e-article Have you filled up your car lately and cringed to see how much a tank of gas sets you back? The average cost of a gallon of unleaded gas has climbed above $3, with predictions that international unrest may drive prices even higher. We still have to drive to work and/or school, so we look for ways to squeeze more miles out of that pricey tank -- but do those tricks you hear about amount to real savings? Here are six gas saving tips that don't actually work, and ways you can make the most of a gallon. 1. Turning Off the AC Air conditioning in your home does a number on your electric bill, so it must drain your gas tank too, right? Not so much. Auto testing at Consumer Reports proves that running the AC uses such a nominal amount more in gas, you may as well turn on the AC and be comfortable on a hot day. Rolling down your windows can add drag, zapping your car's efficiency; for best gas mileage, run the fan and keep your windows rolled up. 2. Filling Up When It's Cold Outside Get your gas in the evening or early morning -- the fuel is cold, and therefore denser. The truth about this myth is that you can barely register a temperature difference, since gas is stored in cool underground tanks, so fill up when you want. There are no savings to be had by waiting until it's cool out. 3. Increasing Tire Pressure To get the most out of your gallon of gas, you should pump up those tires, some say. While driving on underinflated tires can cost you 3.75% in fuel economy, overinflating tires can be downright dangerous, since it reduces your grip on the road and could cause an accident. Proper tire inflation is important for safety and longevity of your tires, but don't expect any significant gas savings there. 4. Pouring Additives Where there's a need, there's a product, but that doesn't mean it actually works. Our desire for better fuel economy seems answered by fuel additives and even bolt-on devices -- but they're a complete waste of money according to the Environmental Protection Agency (EPA). 5. Changing the Air Filter Taking care of your car is a good thing: You'll be able to drive it longer, and get the most for your money. Don't expect maintenance like changing the air filter to get you more miles out of the gas tank, though. Consumer Reports tests have shown that with today's computerized cars, clogged air filters don't actually reduce fuel economy. Take care of your car to make it last, but don't look at air filters to reduce your gas expense. 6. Keeping the Engine Running Starting a car sucks up fuel, some say, so keep the engine idling when possible. That's bad advice: today's fuel-injected vehicles are efficient and don't waste gas during start-ups anymore. In fact, idling can cost you up to half a gallon of gas an hour, so turn off the engine if you're not going anywhere. The Bottom Line There are a lot of myths out there when it comes to saving gas. So what does actually help improve your fuel economy? Instead of looking at your car to improve fuel economy, try changing the way you drive. Calm driving on the highway -- not zipping between lanes, tailgating or revving the engine so you quickly get up to speed -- can improve your fuel efficiency a whopping 33%. Remove any excess weight from your car to bump fuel economy another 2%, and drive sixty miles an hour (when the speed limit allows) on the highway for another 23% improvement in fuel efficiency. In the end, best fuel economy comes from a calm and safe driver, something that's a good thing regardless of the price we pay at the pump.

-

Are you a driver who does not use his vehicle too often? We have good news for you. DirectAsia.com an award winning online insurer has launched a new car insurance aimed at leisure drivers. This first of a kind motor insurance is available to drivers who use their car less than 8,000km per annum. You do receive all the coverage but just at a reduced premium, including Off-Peak cars. Interestingly drivers who drive less than 8,000km per year are less prone to accidents. As such DirectAsia would like to reward such drivers by providing savings to their premiums. Through introduction of such premiums motorists can be expected to save between 10 to 15 percent, all you have to do is drive less. CEO of DirectAsia.com Simon Birch commented the new low mileage based insurance saves motorists money if you do not drive frequently or you possess a second vehicle that is not used often. He is also delighted to be the pioneering company to offer such a service in the tropics. DirectAsia.com, is a new and innovative online insurance provider that began operations back in June 2010. As a dedicated direct personal lines insurer, DirectAsia.com provides fast and easy access to insurance needs online. They are fully licensed and regulated by MAS (Monetary Authority of Singapore). The company

- 7 comments

-

- advice

- discussions

- (and 11 more)

-

My wife and i are in our early 30s with a young baby. We dont have much savings and we are both grads working decent jobs. I think we only have like 50k savings combined (excluding insurances, CPF). Is this normal? I have to add that we are not spendthrifts. What is the normal savings for average people in my age group leh?

-

The Straits Times; Published on Mar 8, 2012 Protect CPF savings from inflation TO ENSURE the adequacy of retirement funds, Central Provident Fund (CPF) members should consider their 'real' returns on CPF savings, after subtracting inflation, which reduces future purchasing power ('CPF Life: Wouldn't the monthly payout be eroded by inflation?' by Mr Christopher Teng; yesterday)[alt link]. The Minimum Sum is adjusted for inflation, yet the Ordinary Account (OA) and Special Account (SA) 'nominal' interest rates are not; and neither, it seems, are the CPF Life payouts, which thus create significant exposure to inflation. For example, if the SA nominal rate is 4 per cent, and inflation is 6 per cent, one loses 2 percentage point purchasing power. From 1995 to 2006, this was not so important because inflation was low, between a negative 0.4 per cent and 2 per cent, averaging 0.87 per cent annually. But from 2007 to last year, inflation rose dramatically - as high as 6.6 per cent (2008) and 5.2 per cent (last year), averaging 3.5 per cent over this five-year period, which is four times higher than that for the 1995-2006 period. So, at a 4 per cent SA rate, the real return from 1995 to 2006 would have averaged 3.13 per cent (4 per cent minus 0.87 per cent), and from 2007 to last year, a low 0.5 per cent (4 per cent minus 3.5 per cent). To demonstrate the magnitude of these real return differences over a career, compound $10,000 annually over a 30-year period. Using a 3.13 per cent real return yields $25,200 after 30 years, while 0.5 per cent correspondingly yields only $11,600. Thus, today's real yields will leave retirees with only half the real purchasing power of the earlier period, and their CPF Life payouts are also exposed to inflation. While future inflation and OA/SA rates are unknown risks, it is clear that inflation can affect retirement purchasing power dramatically. Without inflation indexing, CPF members seem to have no means to maintain purchasing power over the long haul should inflation continue or escalate rapidly. Perhaps returns in CPF retirement accounts should be set at a minimum real yield to factor in inflation. Many countries offer inflation-protected notes and bonds, so this is a mainstream practice. The Government of Singapore Investment Corporation, which invests the CPF capital, has a target long-term real return that takes inflation into account. Factoring inflation protection into the SA rate assures CPF members, who will rely on their retirement savings, that these are protected from the unpredictable ravages of inflation. Michael Dee Copyright

-

it works for me not sure if it will for you. as my ride is a heavy one 230JM. i pump pertol only 1/4 max 1/2tank if plan to drive long distance. i pump frequently. i notice m fc hit new landmark of 9.5km/l used to be 8-8.5 prev. does this sound logic to you? cheers

-

Been encountering a number of my friends (30 & under) getting into minor financial problem despite not having a family & holding a stable job. Most of them do not own cars. So like to find out how the bros in MCF fare. For bros who are 40 & under, can also poll in how much you have in savings 10 years ago (salary din increase much since last 10yrs ). Edit: Applicable for those who have a tertiary education. ITE & A level included.

-

Just to share Enjoy up to 16.28% in savings at SPC this Christmas from 23 to 25 Dec 08 with your POSB Everyday and SPC & U card SPC&U Card Discount* = 9% Rebates with your POSB Everyday Card = 8% on Nett Purchase Total: 16.28% For example Purchase Amt = $100 SPC & U Card Discount 9% = ($9.00) Nett Purchase Amt = $90 8% rebates with POSB Everyday Card @ 8% = $7.28 Saving = $16.28 (16.28%) http://www.dbs.com/posb/cards/everyday/pro...es/default.aspx

-

Does anyone still does that in Singapore? It appears that this is also a vanishing trait. I know some pple do not hv savings everymth. So, the variable bonus & 13th AWS (if any) that they get will be taken as savings. Do you set aside a percentage of yr nett salary as savings or do you save only when there's loose change at the end of the month? Plse participate in the poll & it wld be interesting to see how many squirrels we have here in MCF

-

http://www.sgcarmart.com/main/info-2EWLIqjo-1001.html Great savings of at least $6,000 off this 3 mth old Camry 2.0A from Borneo Motors - depends on your bargaining power.

-

There will be a mini carnival on the 22nd of May from 7pm to 2am which will be this coming Saturday at Prinscep Street. There will be 20% discount specially for MyCarForum members on sunshades, denim bags, T-shirt in can, among other barang!!! On top of that, a renowned car modifier, better known as Ah Boy in motorsports competitions in Singapore and Malaysia, will be there with his award-winning Nissan Skyline GTR to offer free consultations to all car owners and do neon lights installations and car decals. There will also be a special tyre sealant that will make sure your car tyres will never ever go flat anymore. It has been tested by SETSCO to be 100% effective and will NOT affect race performance. For this coming Saturday only, all car owners will enjoy a $88 special package offer for ALL 4 TYRES!!! On top of that, Benny from Doggies Inn will offer 15% discount on all pet accessories and food. So come on down this saturday and have a great time for yourself, friends, and your pets More promotions will be updated here in the evening. Map of the place can be viewed at http://f2.pg.photos.yahoo.com/ph/xabreooth...1&.dnm=cd72.jpg - This announcement was done to cut down the cost on advertising to bring the savings to you, the customers! -

- 12 replies

-

- This

- announcement

-

(and 7 more)

Tagged with: