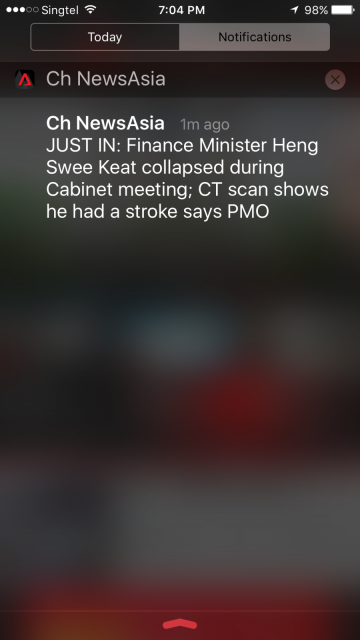

Search the Community

Showing results for tags 'collapse'.

-

already kena 2 fires, now ceiling collapse!! super suay

-

Global car giant Nissan is on the brink of collapse after longtime partner Renault revealed plans to sell off its interests in the Japanese carmaker. Insiders claim Nissan, one of Australia’s best-selling car brands, only has one year to survive as the company scrambles to backfill the gaping hole Renault’s departure will leave in its finances. Nissan is now searching for a new investor to ensure its survival beyond 2025, according to reports. Two people with knowledge of the talks reportedly said Nissan was seeking a long-term, steady shareholder like a bank or insurance group to replace some of Renault’s equity holding. “We have 12 or 14 months to survive,” a senior official close to Nissan said. The bombshell departure of Renault comes as Nissan attempts to finalise the terms of its new electric vehicle partnership with arch rival Honda. Reports indicate Nissan is considering “all options” for its future and has not ruled out having Honda buy some of its shares. A series of restructuring measures have been launched at Nissan on the back of declining sales in both China and the US, insiders said. French carmaker Renault has also signalled its willingness to sell its Nissan shares on to Honda as it restructures a 25-year partnership that began in 1999 when Renault saved Nissan from bankruptcy. Historically fierce rival in the automotive market, the Renault departure could be a blessing in disguise for Nissan and Honda as they plan an alliance to combat China’s growing dominance of the electric vehicle market. Nissan and Honda are currently in talks to develop EV and software technology as China ramps up its own EV development and exports globally. An alliance between Honda and Nissan on EVs could help those brands find space to play in the North American market – a particularly poignant point given the change in the political landscape that has seen re-elected president Donald Trump push for more jobs in manufacturing in the US. “This is going to be tough,” a senior official close to Nissan was quoted as saying to the Financial Times. “And in the end, we need Japan and the US to be generating cash.” Nissan has been criticised for falling behind on hybrid technology, with rivals such as Toyota, Hyundai and Kia having capitalised on the boom in petrol-electric models. Nissan does offer its own take on the hybrid theme with its e-Power models, which use a petrol engine only as a generator for an electric motor and battery pack. That tech is available in high-grade versions of the Qashqai small SUV and X-Trail family SUV in Australia. Indeed, Nissan currently has a raft of new or fresh metal on the way in Australia, with a facelifted Qashqai due early in 2025, while in other markets the brand has just refreshed models like the Kicks compact SUV, which plays a price-pivotal role in the US. The brand still hasn’t launched the Ariya electric SUV in Australia, however, with some industry insiders questioning whether the model – which originally debuted in early 2022 – will ever actually go on sale in Australia, with its debut having been pushed back multiple times over the past few years. WILL MITSUBISHI JOIN FIGHT AGAINST CHINA? There is also potential for another Japanese carmaker, Mitsubishi Motors, to enter a potential Nissan-Honda alliance due to Nissan owning a 34 per cent stake in Mitsubishi. While Nissan reportedly plans to cut that stake down to 24 per cent as part of the ongoing restructure with Renault, it leaves the door open for a three-way Japanese alliance. Mitsubishi Motors has said no specific details had been finalised but refused to rule out a potential alliance. “We are currently exploring all possibilities and are eager to co-operate in areas where we can leverage our strengths,” a spokesman said. Despite Renault cutting down its interests in Nissan, the French carmaker is not looking to bail out on the Japanese companies entirely. Insiders claim Renault is also mindful of China’s growing power within the automotive industry and recognises the power a Japanese alliance could represent in the rising EV war. The Japanese trio of carmakers would also be keen to leverage Renault’s ability to unlock the European market, the report said. People with knowledge of the talks said broader collaboration involving Renault and Mitsubishi made strategic sense, although the French group added that there were no discussions at present to this end. Nissan Oceania’s newly appointed vice president and managing director, Andrew Humberstone, recently told industry publication GoAuto that the brand is aiming to recapture a top five position in the market, with plans to bring the brand’s local heritage to life as it tries to increase its local sales share. “We’ve been here for decades, and yet we haven’t told that story. This is something we’re absolutely going to change,” Mr Humberstone told GoAuto. News.com.au has reached out to Nissan Australia for comment on the reports around its future on a global scale. https://www.news.com.au/technology/motoring/nissan-seeks-new-investor-to-survive-renault-exit/news-story/bad4d2c2f7388e5f68a9869fafeb7f6c

-

Quote from Yahoo News: 2 shophouses partially collapse at Syed Alwi Road, 6 injured Two shophouses partially collapsed at Syed Alwi Road in the early hours of Tuesday (8 Oct). According to a Facebook post by the Singapore Civil Defence Force (SCDF), the team was alerted to the incident at 1.30am. "Upon arrival, SCDF immediately commenced a search of the area to ascertain if anyone was trapped under the debris. Two search dogs and a drone were also deployed to augment the search operation," they wrote. As passersby reported hearing a loud blast, a firefighting machine was deployed as a precautionary measure, to disperse any potential build up of flammable gases using its water mist spray function. Firefighters rescued a victim who was trapped on the second storey of the affected shophouse at 84 Syed Alwi Road using a ladder. No one was found trapped under the debris, said SCDF. SCDF shared, "Two persons were assessed by paramedics for minor injuries and conveyed to Singapore General Hospital and Tan Tock Seng Hospital. Four other persons were also assessed for minor injuries but they declined to be sent to the hospital." CNA reported that, according to the Building and Construction Authority, the cause of the incident is "suspected" to be a gas explosion.

-

Galapagos rock formation Darwin's Arch has collapsed (CNN) — One of the most famous rock formations in the Galapagos Islands has collapsed into the sea. The top of Darwin's Arch, located in the northern part of the archipelago, fell as "a consequence of natural erosion," according to the Ministry of Environment for Ecuador. Images of the structure, which now consists of just two pillars, were posted on the social media accounts for the ministry on Monday alongside a statement confirming the news. Before: After: https://edition.cnn.com/travel/article/galapagos-darwins-arch-collapses/index.html

-

Wow https://mustsharenews.com/shaw-nex-accident/

- 49 replies

-

- 12

-

.png)

-

-

-

Sorry. Double post. Mods pls help delete. Kam sia too many to count. 😅thank you

-

https://www.channelnewsasia.com/news/business/british-travel-firm-thomas-cook-collapses-thousands-stranded-11933126 Jialat Long time ago, i used for travellers cheques...... Just sharing

- 31 replies

-

- 6

-

-

-

- thomas cook

- travel firm

-

(and 1 more)

Tagged with:

-

https://www.channelnewsasia.com/news/asia/hundreds-missing-in-laos-after-hydropower-dam-collapse-10558270 Poor souls. Thai-South Korean-local joint venture

-

thankfully no serious injuries... Workers hurt after ceiling collapses at RWS casino https://www.todayonline.com/singapore/workers-hurt-after-ceiling-collapses-rws-casino

-

as requested. Police cordons off area as concrete sunshade almost comes crashing down at Tampines Blk 201E Posted on 25 September 2016 | 6,266 views | 8 comments FacebookTwitterGoogle Gmail Share

-

Wall cabinet collapsed in Canberra Residences condo unit

Jellandross posted a topic in Property Buzz

this is a freaking nightmare for any home owner. luckily nobody was injured. FAQs below. Developer: MCC Land (Singapore) Pte Ltd Main Contractor: China Jingye Construction Engineering (S) Pte Ltd TOP in 2015 -

Truly inspirational. Can crawled to 3rd place. https://sg.sports.yahoo.com/news/kenyan-marathon-runner-collapses-crawls-finish-texas-212059802--spt.html

-

http://therakyatpost.tumblr.com/post/99804394381/new-post-has-been-published-on-the-rakyat-post Twitter was abuzz this evening with reports that said the overhead pedestrian bridge near Taman Kobena, Pasir Gudang, Johor had collapsed. The bridge, which is along the Pasir Gudang highway, had reportedly collapsed between 4pm and 5pm today. Netizens shared pictures of the incident on Twitter, showing the entire stretch of the pedestrian bridge having fallen onto the road below. No fatalities were reported as yet, however several vehicles were said to have been damaged in the incident. Work is currently ongoing to clear the area as traffic is not able to go through that portion of the highway. Johors Road Works Department twitted via their account @JKRJohor asking for motorists to opt for alternative roads after they were informed of the incident. - MORE TO COME - Photo from Facebook

- 69 replies

-

- 4

-

-

- pasir gudang

- johor

- (and 5 more)

-

- 29 replies

-

- 2

-

-

http://www.forbes.com/sites/gordonchang/2014/04/13/china-property-collapse-has-begun/

- 156 replies

-

- china property

- china

-

(and 3 more)

Tagged with:

-

very very sad to see these cases especially new school term just started and CNY is coming

-

8 workers hurt, 2 missing in accident at Downtown Line's Bugis MRT By Christopher Tan Eight workers were injured and two are missing when a scaffolding at the Downtown MRT Line's Bugis station collapsed on Wednesday morning. The Land Transport Authority said the incident happend at about 6.50am, when a temporary scaffolding at the site of the new station gave way. It said the structure was about 4m high. 'Eight workers who were working on top of the structure were injured and sent to the nearby Raffles Hospital. One worker has since been discharged,' an LTA spokesman said. 'At the time of report, another two workers are still unaccounted for.' PUB workers were also seen checking the sewage pipes near the site, and police officers were carrying a body tent - usually deployed in cases where deaths occurred - at the site. However, there has been no confirmation of deaths as of now.

- 104 replies

-

- Scaffolding

- collapse

-

(and 3 more)

Tagged with:

-

pics from hwz

-

Speculation about Michael Schumacher's mood continues to rise, but the seven time world champion insists he is "extremely motivated" ahead of the fifth race of his 2010 comeback. After three years of retirement, the 41-year-old German has been consistently outpaced by his Mercedes teammate Nico Rosberg so far in 2010, but will have a car with a longer wheelbase in Spain that should better suit his driving style. "When he has that (revised car) I think we will have to reassess the whole story," commented former triple world champion Sir Jackie Stewart. "If he then doesn't deliver, then I think he has a problem," added the Scot. 70-year-old Stewart thinks part of Schumacher's problem will be reassessing his desire to honour the full three years of his new contract. "You know, I don't think he should have retired when he did in 2006 because I don't think it was out of his system," he said. "This might take it out of his system." Schumacher's old title rival of the 90s, Damon Hill, is not ruling out that "the old Schumacher magic" could soon return. "Is it still there?" he told the Daily Mail, whose headline accuses Mercedes of "wasting money" on Schumacher. "I'm sure that's a question Michael will be asking himself -- and it's one that is starting to become valid after four races," added Hill. In an official Mercedes press release, Schumacher played down the likely effect of the car upgrades for Barcelona but sounded bullish about his own outlook. Team boss Ross Brawn also said the German is "determined to succeed" despite the setbacks so far. Added Schumacher: "Our step forward in Barcelona will be bigger than you can make at each race during the flyaways but it would not be realistic to expect us to suddenly be competing right at the front," he said. "However the good news is that after three years away, I am feeling extremely motivated. So I am clearly ready to take this challenge," added the record winner of 91 grands prix. Source: GMM

-

Toyota states one of the causes of falling car sales

-

In his famous book, The Collapse of British Power (1972), Correlli Barnett reports that in the opening days of World War II Great Britain only had enough gold and foreign exchange to finance war expenditures for a few months. The British turned to the Americans to finance their ability to wage war. Barnett writes that this dependency signaled the end of British power. From their inception, America's 21st century wars against Afghanistan and Iraq have been red ink wars financed by foreigners, principally the Chinese and Japanese, who purchase the US Treasury bonds that the US government issues to finance its red ink budgets. The Bush administration forecasts a $410 billion federal budget deficit for this year, an indication that, as the US saving rate is approximately zero, the US is not only dependent on foreigners to finance its wars but also dependent on foreigners to finance part of the US government's domestic expenditures. Foreign borrowing is paying US government salaries--perhaps that of the President himself--or funding the expenditures of the various cabinet departments. Financially, the US is not an independent country. The Bush administration's $410 billion deficit forecast is based on the unrealistic assumption of 2.7% GDP growth in 2008, whereas in actual fact the US economy has fallen into a recession that could be severe. There will be no 2.7% growth, and the actual deficit will be substantially larger than $410 billion. Just as the government's budget is in disarray, so is the US dollar which continues to decline in value in relation to other currencies. The dollar is under pressure not only from budget deficits, but also from very large trade deficits and from inflation expectations resulting from the Federal Reserve's effort to stabilize the very troubled financial system with large injections of liquidity. A troubled currency and financial system and large budget and trade deficits do not present an attractive face to creditors. Yet Washington in its hubris seems to believe that the US can forever rely on the Chinese, Japanese and Saudis to finance America's life beyond its means. Imagine the shock when the day arrives that a US Treasury auction of new debt instruments is not fully subscribed. The US has squandered $500 billion dollars on a war that serves no American purpose. Moreover, the $500 billion is only the out-of-pocket costs. It does not include the replacement cost of the destroyed equipment, the future costs of care for veterans, the cost of the interests on the loans that have financed the war, or the lost US GDP from diverting scarce resources to war. Experts who are not part of the government's spin machine estimate the cost of the Iraq war to be as much as $3 trillion. The Republican candidate for President said he would be content to continue the war for 100 years. With what resources? When America's creditors consider our behavior they see total fiscal irresponsibility. They see a deluded country that acts as if it is a privilege for foreigners to lend to it, and a deluded country that believes that foreigners will continue to accumulate US debt until the end of time. The fact of the matter is that the US is bankrupt. David M. Walker, Comptroller General of the US and head of the Government Accountability Office, in his December 17, 2007, report to the US Congress on the financial statements of the US government noted that "the federal government did not maintain effective internal control over financial reporting (including safeguarding assets) and compliance with significant laws and regulations as of September 30, 2007." In everyday language, the US government cannot pass an audit. Moreover, the GAO report pointed out that the accrued liabilities of the federal government "totaled approximately $53 trillion as of September 30, 2007." No funds have been set aside against this mind boggling liability. Just so the reader understands, $53 trillion is $53,000 billion. Frustrated by speaking to deaf ears, Walker recently resigned as head of the Government Accountability Office. As of March 17, 2008, one Swiss franc is worth more than $1 dollar. In 1970, the exchange rate was 4.2 Swiss francs to the dollar. In 1970, $1 purchased 360 Japanese yen. Today $1 dollar purchases less than 100 yen. If you were a creditor, would you want to hold debt in a currency that has such a poor record against the currency of a small island country that was nuked and defeated in WW II, or against a small landlocked European country that clings to its independence and is not a member of the EU? Would you want to hold the debt of a country whose imports exceed its industrial production? According to the latest US statistics as reported in the February 28 issue of Manufacturing and Technology News, in 2007 imports were 14 percent of US GDP and US manufacturing comprised 12% of US GDP. A country whose imports exceed its industrial production cannot close its trade deficit by exporting more. The dollar has even collapsed in value against the euro, the currency of a make-believe country that does not exist: the European Union. France, Germany, Italy, England and the other members of the EU still exist as sovereign nations. England even retains its own currency. Yet the euro hits new highs daily against the dollar. Noam Chomsky recently wrote that America thinks that it owns the world. That is definitely the view of the neoconized Bush administration. But the fact of the matter is that the US owes the world. The US "superpower" cannot even finance its own domestic operations, much less its gratuitous wars except via the kindness of foreigners to lend it money that cannot be repaid. The US will never repay the loans. The American economy has been devastated by offshoring, by foreign competition, and by the importation of foreigners on work visas, while it holds to a free trade ideology that benefits corporate fat cats and shareholders at the expense of American labor. The dollar is failing in its role as reserve currency and will soon be abandoned. When the dollar ceases to be the reserve currency, the US will no longer be able to pay its bills by borrowing more from foreigners. I sometimes wonder if the bankrupt "superpower" will be able to scrape together the resources to bring home the troops stationed in its hundreds of bases overseas, or whether they will just be abandoned. What do you guys think?

-

-------------------------------------------------------------------------------- 2 Workers Killed In Miami Crane Collapse MIAMI, March 25, 2008 -------------------------------------------------------------------------------- (AP) A 20-foot-long chunk of construction crane plummeted 30 floors at the site of a high-rise condominium Tuesday, killing two workers and smashing into a home that the contractor used for storage, police said. Five other workers were injured, one critically, at the site of the 40-plus-story luxury condo tower on Biscayne Bay. The part that fell was a section workers had been raising to extend the equipment's reach, Miami fire spokesman Ignatius Carroll said. The crane's main vertical section was intact. The section smashed through the Spanish-tiled roof of the two-story home, which police spokesman Delrish Moss said had been used in the 1998 comedy film "There's Something About Mary." Emergency workers and dogs found no evidence of trapped victims, but fire officials said rescue efforts were hampered because the crane section remained unstable. Rescue workers were trying to secure a severely damaged wall before re-entering the house to check for anyone inside. David Martinez, 31, a pipe fitter, was on the fourth floor of the condo tower eating lunch when the crash occurred. "It was like a small earthquake," he said. "We looked outside, and we couldn't even see." It took several minutes for the dust to clear, Martinez said. One of those killed died in the house, and the other died at a hospital, Moss said. Mary Costello, a senior vice president for Bovis Lend Lease Holdings Inc., which was managing the construction, said the accident occurred when a subcontractor tried to raise the crane section and it came loose. The company is cooperating with investigators, she said. "Our hearts are heavy at this moment for the two deceased individuals, including one of our own employees and the additional injured workers," she said in a statement. The subcontractor, Morrow Equipment Co., and the tower developer, Royal Palms Communities, did not return phone messages seeking comment. The U.S. Office of Safety and Health Administration had two investigators at the site. Darlene Fossum, an area director for the agency, said Bovis Lend Lease had partnered with OSHA in the past and was considered a company that went "above and beyond" in terms of safety and health. Fossum added that OSHA issued five violations against Morrow in a December 1999 incident in Florida, but those mostly involved problems with digging and not cranes. The Salem, Ore.-based company has faced 15 inspections nationwide. The state of Florida does not license or regulate tower cranes or crane operators, but bills moving through both houses of the Legislature would change that. In 2006, a fatal crane accident in Miami-Dade County prompted local officials to work with industry leaders on an ordinance that would beef up inspections and safety measures for lifting cranes. The law is to go into effect Friday. Tuesday's accident came 10 days after a 20-story crane toppled at a New York construction site, killing seven people. The crane demolished a four-story town house and damaged several other buildings. New York City officials said Tuesday they have told contractors they can't raise or lower large cranes at construction sites unless a buildings inspector is there.