Search the Community

Showing results for tags 'Using'.

-

Is it a good idea to use a blower to dry the car? I was told that limiting contact with the paintwork will help prevent scratches.

-

Dear all, Just would like to find out what are the CPU brands that you guys are using. Eg. If you have 1 PC using AMD and 1 notebook using Intel, you select "Desktop - AMD" & "Notebook - Intel". And so on. Intel? OR AMD? Multiple choice is allowed.

-

Just for fun: 😁 56 Delightful Victorian Slang Terms You Should Be Using In 1909, writing under the pseudonym James Redding Ware, British writer Andrew Forrester published Passing English of the Victorian era, a dictionary of heterodox English, slang and phrase. "Thousands of words and phr...

-

Who here is still using STP Oil treatment? I am still using it for my old Toyota. Its one of the cheapest and oldest oil treatment out there that actually works. No magic about the product. Mainly some viscosity enhancers and lots of Zinc! Thats about all. Cause my car needs a 50wt oil, thus I decid...

-

It seems like the more popular brands are Blackvue or Iroad cameras. I am given the Blaupunkt BP-9.0A with the following specs Resolution : Front 2MP FHD 1080 30fps, Rear : 2MP FHD 1080 30fps Wide viewing angle: Front - 140, Rear - 120° Screen display: Front, Rear, PIP 3.5” touch...

-

So how are you use the $500 that the govt have given us? Last week kopi with my fren, he take that $500 and go take Taxi License. Quite smart thou.

- 129 replies

-

- 1

-

-

- skillsfuture

- $500

-

(and 3 more)

Tagged with:

-

wonder how many bros/sis here use hose connected to the paying taps to wash their cars in mscp? saw a guy using a hose @ a mscp near my place, so now thinking of getting a hose & sprayer too. wondering if there's an ideal length for the hose so that the spray of water would be strong enoug...

-

How come technology still so outdated ?

-

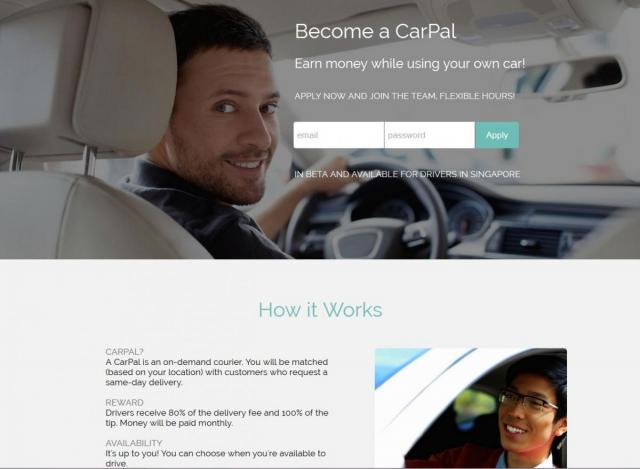

Come across this advertisement in my Facebook , for those who wish to earn while driving , this maybe be a great opportunity.

- 59 replies

-

- 4

-

-

- courier service

- online business

-

(and 4 more)

Tagged with:

-

Do all these so called Fuel Saving Gadgets really works? Some of those in the market are shark plug. panther plug and some magnetic gadgets to be inserted at the fuel cable etc.

-

When parking the car, is it ok to leave the auto transmission in P mode while not using hand brake or parking brake? Will this damage the transmission, even when not parking on a slope or incline?

- 49 replies

-

- 1

-

-

- leave

- transmission

- (and 4 more)

-

Hi all taxi uncles or aunties, i am in need (desperately) for advice on how to make a little bit more using taxi share under smrt? Last time i can earn about $12 per hr after deducted rental and fuel. I started to drive again as i kenna fired by company again. Averagely i earn around 6 to 7...

-

This was brought up a few days ago, in the "President" 's policy suggestions... Instead of stopping people using their CPF to pay for their mortgages, why not reduce the prices if HDB flats and not peg them to market prices with land prices? Then Singaporeans will have more money to save with lower...

-

Huh?? Didn’t the petrol companies warned us last time NOT to use handphones at petrol stations as it can cause explosions??....

- 24 replies

-

- 4

-

-

- caltex

- explosions

-

(and 3 more)

Tagged with:

-

Last night (1st May), I was turning out of Giant @ Tampines. Upon reaching Tampines Ave 10 towards TPE, I saw a TP bike whizzed pass me. Although I was on the phone, I was using my trusty bluetooth earpiece. The TP took a look at me and proceed on front. Then I saw the TP turning on his 'ber...

-

Guys, I am thinking of changing my alarm to 2 way type, budget under $300. I google awhile, the most common people recommend in other car forum is SPY alarm. But never say much about the pros and cons. Some talk very highly of them while some say the SPY alarm gone haywire or the remote spoil and wa...

-

as above..........

-

Can count w one hand the number of times i used it. Anyone else think its a waste of time esp in SG start stop traffic?

- 82 replies

-

- 4

-

-

- triptronic

- gear

- (and 5 more)

-

Thinking of getting a set of WMF pressure cookers for my wife. That's the only thing that's missing in her arsenal. Care to share your experience? Thanks! Good gravy! I'm still "loginable"

-

When you use your credit card buying something oversea, sometimes the merchant will ask do you want to charge in SGD or the local currency. Which is better??

- 77 replies

-

- credit card

- visa

-

(and 5 more)

Tagged with:

-

Dear forumers, I am planning to resign from my current company soon. I intend to offset my earned leave (30 days) to offset against my notice period of one month. This is allowed under MOM's rules; however, I don't get paid for my leave, and I can immediately start work with my new emplo...

.png)