Search the Community

Showing results for tags 'Retirement'.

-

Roughly how much for a decent lifestyle excluding overseas travel? 3,000RM per couple? 5,000RM per couple? For views, thanks.

- 1,201 replies

-

- 1

-

-

- retirement

- malaysia

-

(and 3 more)

Tagged with:

-

I wanted to but everythings soooooooooooo expensive nowadays ..... I am one of the 78% ..... yahoo news: 3 in 10 Singaporeans eye retiring before hitting 60 years old And they'll rely on their savings. According to Nielsen, 78 percent of Singaporean respondents say they plan to rely on their personal savings and investments as primary source of income after retirement. Respondents from Singapore stood most confident about utilizing personal savings and investments as their primary source of income when retired as compared to the other countries in Southeast Asia. The Nielsen Global Survey about Aging, which polled more than 30,000 Internet respondents in 60 countriesi, also revealed that 29 percent of Singaporean respondents plan to retire before they reach the age of 60 years. For almost half of Singaporeans (45%) their ideal retirement age is younger than their planned/actual retirement age. In other Southeast Asian countries, even more respondents plan to have retired below the age of 60 years: Malaysia (50%) Indonesia (49%) Vietnam (44%), Thailand (33%) and The Philippines (30%). “The fact that most Singaporeans rely on their own savings and investment speaks about their desire to be self-reliant and self-sufficient,” said Luca Griseri, Head of Nielsen’s Financial Services in Singapore and Malaysia. “It presents an opportunity for financial service providers to facilitate this by offering adequate financial products that help citizens build their retirement funds early on. Information about what are the correct strategies for building a retirement nest is key, so that Singaporeans can start planning for their retirement early. link: http://sg.finance.yahoo.com/news/3-10-singaporeans-eye-retiring-061700591.html Working more than 40 over years and time to relax leow ...

- 3,270 replies

-

- 1

-

-

- singaporean

- retirement

-

(and 1 more)

Tagged with:

-

Is your CPF enough for retirement? i like one caller said ... since the panel suggests that the onus lies on the cpf holder to manage their finances and be prudence in order to have enough money for retirement then return cpf money to us ... let us manage our own money .... no point to have cpf ... since cpf is not enough for retirement ... lolz anyway, i support cpf scheme which is a national scheme to "force" people to save up but the return generated in cpf is too low to offset the rise of cost of living and not to mention the OA is almost depleted for housing. final vote result

-

https://www.straitstimes.com/opinion/forum/forum-seniors-should-not-stand-in-the-way-of-younger-staff Forum: Seniors should not stand in the way of younger staff Singapore must tread carefully in handling the issue of raising the retirement and re-employment ages. Care must be taken not to cause resentment on the part of younger workers. Workers in their prime (early to late 30s) might not be able to advance in the company's hierarchy if the seniors above them won't retire. Older workers who can afford to retire early should give the younger generation a chance to climb up. They can always volunteer or offer mentorship to the young if they are bored with retirement. If too many seniors cling to their jobs even when they don't need them, there may be fewer opportunities for the next generation. Francis Cheng Seems that old folks not needed in our country, just like what COVID-19 is doing to us.

- 410 replies

-

- 1

-

-

- retirement

- age

-

(and 8 more)

Tagged with:

-

Been happening for some time but this is a very good case where both cannot meet minimum sum https://singaporeuncensored.com/couple-divorce-so-they-can-buy-another-hdb-flat-to-earn-rental/ COUPLE DIVORCE SO THEY CAN BUY ANOTHER HDB FLAT TO EARN RENTAL ByHello Its me September 8, 2022 Bumped into an ex-colleague (who is the same age as me) earlier and had an interesting brief catch up chat over coffee. He and his wife are now divorced. But except that there is nothing wrong with their marriage and they are still living together. The sole purpose of getting the divorce is to be able to buy ANOTHER HDB FLAT (under the singles scheme). So they collectively own two HDB flats as two single individuals. You see, he was a manager that had recently been displaced by cheaper foreign labour. As all of us know, at our age, there is a real challenge in getting a job that would pay him a decent salary. Yes, there are lots of employers that wants to hire him. He is, afterall, a qualified professional with a wealth of 30 years’ experience behind him. However, these greedy employers are just not willing to pay him his worth and wants to exploit his skills and experience for a mean salary. He refused to prostitute his skills for a low salary. He end up driving a cab that (ironically) pays him more than any of the offers that he had received. He won’t be getting any of his CPF money next year because he won’t be able to meet his minimum sum. All his past CPF contributions (more than $800K) had already gone into his 5rm HDB flat that they are staying in now. His wife has some CPF left but she (too) won’t be able to get a single cent out in a few years’ time because she (too) won’t be able to meet the minimum sum as well. So they planned, got a divorce and bought a second HDB flat just before they could lock away her CPF as the minimum sum in her CPF. They then moved into the new flat and rented their older flat out legally because he had already and duly met the “Minimum Occupation Period” required for the legal renting out for that flat. And this rental income will serve an additional passive retirement income. When I asked if he would be flouting any HDB regulations by doing that, he replied, 1) They are legally divorced and they are both legally SINGLE now. 2) He can retain the existing 5rm flat under the singles scheme and his wife is eligible to buy another flat under the singles scheme. 3) There is no law in this land that prohibit two single persons (divorced or not) from living together as a couple regardless if they were previously married or not. 4) At his age, being legally married is just a marital status. It doesn’t stop them living together as man and wife. They both had made their wills. 5) Instead of having the money stuck as a minimum sum in their CPF, they might as well utilise whatever that they can get out of their CPF so as to get an alternative passive income since:- – – a) they won’t be able to get any of their CPF money anyway – – b) even when they do get their CPF monthly payouts after the age of 65 yrs old (which is still a long way to go), the amounts will be so miserable that they would hardly be able to do anything decent with it anyway… – – c) so…. they might as well get a second HDB flat with whatever money that they can siphoned out from their CPF (before the money is being locked away instead under the minimum sum)…. rent it out and (at least), the monthly rental income of $2,500 can help them live a more dignified retirement IMMEDIATELY (right away) rather than waiting till they reach 65 yrs old for that miserable delayed CPF payout that is so insignificant…. Thinking aloud now…. could this be the new norm of retirement in Singapore that Singaporeans will be planning for? Wouldn’t it be so sad that we have to come to this, in order that we can respond to how our hard-earned CPF money is being wilfully and forcefully withheld from us…

- 67 replies

-

- 9

-

-

-

-

.png)

-

- divorce

- retirement

- (and 15 more)

-

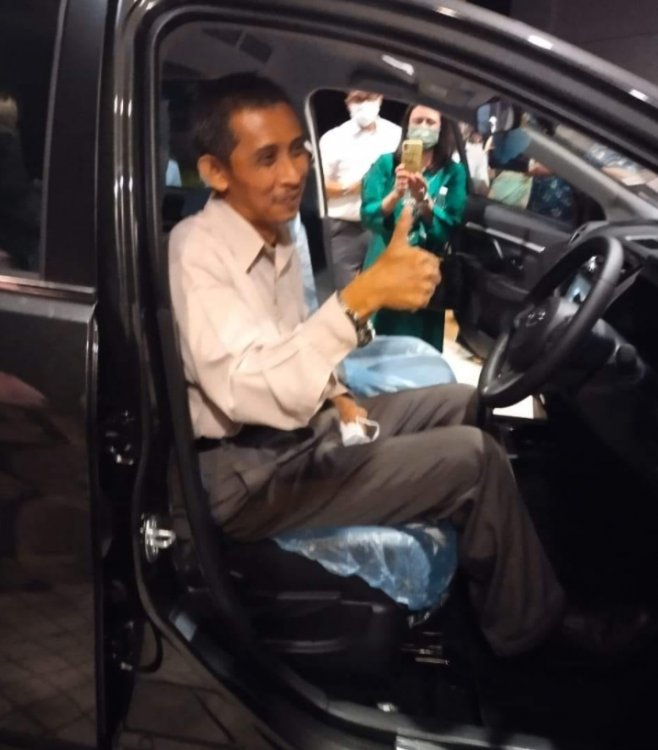

https://waupost.com/msian-students-pool-money-together-to-buy-their-beloved-teacher-a-rm70000-car-for-his-retirement/ must have been extremely well-liked to have received such a lavish gift by students from 38 spm batches spannin 1980 to 2021 Paid off in full too In sg context the aruz will set u back by at least 100k but maybe u have to buy ur own coe 😅 Good gesture

- 18 replies

-

- 12

-

-

-

.png)

-

The best way for Singaporeans to prepare for retirement is to use less of their Central Provident Fund (CPF) money when they are young. Minister in the Prime Minister's Office Lim Swee Say said this will ensure the current level of CPF payout can be maintained over time, and not be eroded by inflation. Mr Lim, who is also the labour chief, made that point when speaking to reporters on the sidelines of the closing of the Singapore Model Parliament on Sunday. At the event, Mr Lim shared his experience with students when he was an MP debating policies at the old Parliament House. He said policies are not a one-off exercise, but they keep evolving. One policy which has received much attention recently is the CPF. Mr Lim said the labour movement has been watching the debate closely, and wants to ensure that what is discussed does not create confusion among workers and union leaders. "Everyone must remember, first is that CPF is your money, nobody can take that money away from you. You have your money, you have the account, and you receive the statement, the account on a regular basis. So, you know how much money you have in the CPF,” he said. The labour chief said CPF money is also 100 per cent safe, and is protected against events like the global financial crisis. One important objective of CPF is to cater for retirement. Mr Lim said: "Instead of thinking about whether you can spend your savings in the CPF at the age of 55, I think we should think about how can we help our Singaporeans to continue to remain employed, to continue to earn a good living, continue to have good jobs, and at the same time to continue to contribute to the CPF because the more money they have in CPF, the longer they defer the use of the CPF -- this will mean they will have more for retirement." For the past three days, some 100 students took on different roles as MPs debating national issues at the Singapore Model Parliament. The Singapore Model Parliament provides students with a platform to undertake parliamentary roles and debate national issues. Many found the experience enriching. Kwek Jia Hao, a student who received the “Best Ruling Party MP” award at the event, said: "The key challenge is to persuade the opposition on the rationale and objective of policy making, that we want the beneficiaries of policy making to be Singaporeans." The Singapore Model Parliament has been held annually since 2012 at the Art House Chamber, where the Singapore laws were passed from 1955 to 1999. The event aims to underscore the importance of active civic participation, especially among Singaporean youths. Source: http://www.channelnewsasia.com/news/singapore/use-less-cpf-money-to/1191064.html?cid=FBSG ------------------ full call..anyone?

- 1,002 replies

-

- 4

-

-

-

- cpf

- retirement

-

(and 3 more)

Tagged with:

-

Another shocking news..... MML just said the retirement age will be 67 in future and later on, it will be case by case basic with the employers... If you can still work at 67, just accept any jobs and dont be choosy. If MML is still wanted by the team thunder, he will still work too... Aiyo, he and us differnet leh... He at 67 working and sitting with aircon on and receiving with a VERY WELL TO DO pay... how to complain.. Us.. working like s--t, and by 50 if u are still around in the company, u should thank yor lucky star... Most I see, by 60, already working as cleaners, guards etc... Even if u want to work at labor jobs, also no one wants u... For those towkays, no need to say lah... u want until the company goes down also no problems... just normal folks like us will suffer. I already give up on my CPF withdrawal...

- 647 replies

-

- Retirement

- Going

-

(and 2 more)

Tagged with:

-

What say you?

-

Former school sites could become retirement villages https://www.straitstimes.com/singapore/housing/former-school-sites-could-become-retirement-villages Govt studying suggestion by MP, who cited cost savings and ageing in place as benefits of ideaSchools which once echoed with the voices of children playing may one day be hubs of community living for the elderly in Singapore. A suggestion in Parliament this week by Bukit Batok MP Murali Pillai to turn vacant school sites into retirement villages is being studied by the authorities. National Development Minister Lawrence Wong said of such projects in a written reply: "Their location within established housing estates will enable residents to age in residential surroundings. "Their relatively large site area can accommodate a significant number of housing units and common spaces, allowing residents to interact with one another and develop a sense of community. "However, there are also costs involved to rejuvenate the ageing vacant school properties and reconfigure them for housing purposes." Mr Murali told The Straits Times that cost savings are the main reason behind the idea, saying that when developers build retirement homes, the higher capital expenditure is passed on to seniors. "This option of ageing graciously in-situ with fellow seniors would be an attractive option," he added. MacPherson MP Tin Pei Ling said the idea allows facilities and services to be located together, bringing convenience to the elderly and using resources effectively. But she added: "The design also has to consider: How do we ensure the elderly are not living in an isolated sub-community and are integrated into the wider community?" Bishan-Toa Payoh GRC MP Saktiandi Supaat, a member of the Government Parliamentary Committee for National Development, said the proposal could help to maximise space, but added that there are other needs of residents and the dynamics of the area for constituencies to be considered too. Veteran real estate consultant and academic Steven Choo agreed that savings would be passed on to buyers if the means of sale or lease are arranged by the Government. "I am excited about this idea," said Dr Choo, who studied retirement housing solutions in Hong Kong and Japan as a developer. "Retrofitting of a school compound for residential use is very doable." He said he has not seen such a project in Singapore, and it would be great to have a successful demonstration project. Dr Choo's office in Kim Yam Road is located in commercial building The Herencia, which used to be Nan Chiau High School. He enjoys its high ceilings. Some residents were also receptive to having such retirement villages in their backyards. Retired accountant Agnes Mak, 67, who lives next to the empty Bishan Park Secondary School vacated earlier this year, said: "I wouldn't object to it because the elderly can mingle with residents in the neighbourhood, which is good." Financial planner Tan Wen Man, 28, who lives next to the empty Bedok North Secondary, also vacated earlier this year, said: "I won't mind because the elderly are not noisy and quite friendly. If it is a primary school, it will be noisier." According to a Straits Times report in February last year, due to falling enrolment and mergers, there were 11 schools vacated in 2016 and last year, with four more to be vacated this year. At least nine other former school sites managed by the Singapore Land Authority are vacant state properties. The Academy of Singapore Teachers, the Singapore Red Cross and the Enabling Village are located in former school compounds. The Government is looking for ways to house the elderly as the population ages. The first Housing Board "retirement kampung", Kampung Admiralty, which has healthcare and wellness facilities for seniors, was opened officially in May.

- 12 replies

-

- 3

-

-

- retirement

- schools

-

(and 6 more)

Tagged with:

-

Hi Am a noob in ppty, only got 1 ppty....HDB. Anyway, thinking of getting one landed at Penang to retire cos wife nag nag about life here and wanted to retire in a lesser pace with her siblings and relatives there. Anyone bot landed in Penang? Went there a few times over past few years and it seems there's some appreciation. But am a noob in ppty so all views welcome.

-

Something serious, just to see anyone had signup for prudential prusave plan or similar. Accordingly to my retirement plan, I need to dump 1k every month until 65 years old. What alternatives would I have? 1k is not a problem as long as I am employed working but had my reservation in case something happens ie kanna sack!

-

The CPF salary ceiling, the maximum amount of ordinary wages that employee and employer contributions are calculated on, was raised from $5,000 to $6,000. "Middle-income Singaporeans will be able to accumulate more CPF savings during their working years," Deputy Prime Minister Tharman Shanmugaratnam said when he announced the latest change during the Budget in February last year. At least 544,000 CPF members are expected to benefit. - See more at: http://news.asiaone.com/news/business/more-cpf-savings-new-rules#sthash.pajiY2Zl.dpuf ==== 1. There are 544,000 people earning $5000 or more here. Excluding sole proprietors, directors and private tutors. 2. Each person (and employer) will pay $370 more monthly. Gov will receive >$200mil cash monthly. Or gov really short of cash meh? 3. $370 more in the CPF account. About $200+ can be used for housing loan. Positive impact to the property price. 4. $200 less take home pay.... Retail business and COE.... down down down. 5. Boss will tell us... "You already got $170 increase in your CPF. No increment this year." Are we really richer? The ChengHu is for sure.

- 275 replies

-

- 15

-

-

Some frens has suggested to sell and cash out the earning from the 09 /10 units that were purchase. The quantum gain is 300 to 900 K Then stay with parent / rent and look for distress sales My thoughts is can sell, but the TDSR is preventing from buying again based on the loan limit and the age as well as the interest rate. And like some who missed out on the earlier period, the rental of 2.5K to 3.5K for 2 years could have being made for better use to service the loan with the assumsion that the property may appreciate further For me, if I were to sell, I would most likely drop back to HDB and have a nice nest egg for early retirement ... But as the rule is , if you have private, you cannot buy HDB and the gains tax is a killer if you have sold in years before 2000.

- 81 replies

-

- financal crisis

- speculation

-

(and 3 more)

Tagged with:

-

http://www.formula1.com/news/headlines/2012/10/13863.html

- 29 replies

-

- Schumacher

- announces

-

(and 2 more)

Tagged with:

-

When the race is run and the crowds have gone, and the cheers of victory have passed into silence, what use remains for a racing car? The plinth, the velvet rope, a forgotten, dusty corner of some museum? Not here. Deep below Mazda North America's research and development offices in Irvine, California, there is a basement. It is not so much a cellar, though, as a hallowed paddock for hard-charging thoroughbreds. As the steel entrance door rolls upwards, lights turn on in sequence, revealing machines of various vintages, in varying states of undress. For fans of the rotary engine, it is nothing short of a treasure trove. Closest to the door is the RX-2 campaigned by Car & Driver magazine's Don Sherman in 1973. Modified for International Motorsports Association (IMSA) Racing Stock class, its 12a rotary unit produces 218 horsepower at a Ferrari-like 8,400rpm. Don Sherman's victories in the pictured RX-2 gave Mazda its first road racing wins outside of Japan. Without mufflers, it is easily the loudest thing down here. So ear-splitting is the racket that specialised sound-suppressors were fitted so mechanics would not go deaf when the engine idled in the garage. The RX-2 provided the first competition wins outside Japan for Mazda, establishing the brand's performance credentials right from the start. The pinnacle of Mazda motorsport history is the orange and green-liveried 787B's win at the 1991 Le Mans 24 Hours endurance race. Mazda remains the only Japanese manufacturer to have won the premier prototype class, and while the race-winner currently sits at Mazda's factory museum in Hiroshima, its sister car is here, being fettled to race. While bodywork panels have been removed to facilitate a transmission service, the car itself looks essentially brand-new. It has also been modified. “We call it the 'Davis Dimple,'” explains Jeremy Barnes, public relations director for Mazda North America (MNOA), gesturing towards a curious bump on the car’s canopy. “We had to custom-mould the door to make room, and pour a special seat.” The roof bulge, or “dimple”, is reminiscent of the modification made to the Le Mans-winning Ford GT40 campaigned by Dan Gurney in the ‘60s, which required the change to accommodate its pilot’s long torso. Here, the tweaks were undertaken so Robert Davis, MNOA vice president of operations, could fit. Compared to the compact Japanese drivers who piloted this car to an eighth-place finish at Le Mans in 1991, Davis is a hulk, wearing the car like a 700hp, 1,800lb glove. The IMSA RX-7 sporting a white and green livery. It doesn’t take long to suspect that nearly everyone at MNOA is involved with either racing or supporting these machines at heritage events. Barnes drives an IMSA RX-7 GTO at tracks such as Mazda Raceway Laguna Seca, on California’s Monterey peninsula. The RX-7 GTO is a 600hp beast that he says “is always trying to hurt you. That's why I like driving it so much.” A more modern prototype racer is here as well, an RX-792P. Like the 787B, it is powered by a four-rotor, 700hp engine, and neither it nor any other machine here is driven gently on the track. “Our CEO Jim O'Sullivan told us, 'I want to have the cars run, and run up front,'” Barnes says. They are also very well cared for. Randy Miller, a wiry young man with a megawatt grin and a rotary engine cutaway on his T-shirt, is charged with keeping the cars in fighting shape. “There's no Haynes manual for these things,” he quips, referencing a widely used series of mechanical guides. But he is clearly adept at his job; it doesn’t hurt that he is a certified master fabricator. Tucked deeper in the basement is a vehicle the size of a CX-9 but with the aerodynamic properties of a lunchbox. Miller built this all-electric tool transporter from scratch, having tired of lugging tool chests back and forth to the race pits, and it includes a generator, car-lift and row upon row of sliding drawers. Mazda works with several restoration companies to complete their cars, but also has considerable in-house resources. The mirrors on the 787B, for example, as well as the "Davis Dimple", were custom-made on premises. Miller doesn't always have to work alone either, as many staff members volunteer their time and talent to get things ready for race weekends. The 1967 Luce coupe was Mazda’s only rotary-powered front-wheel-drive car. This commitment to racing infuses many of the rare street cars tucked away among the competition vehicles. There are oddities such as a Japan-only three-rotor twin-turbo Cosmo from the 1990s, as well as a 1967 Luce coupe: the only front-wheel-drive rotary-powered car Mazda ever made. The only left-hand-drive RX-7 Spirit R ever produced was specially modified for a Mazda executive in the US. More prosaically, an extremely low-mileage 1978 GLC hatchback stands as an example of the practical vehicles that helped foot the extravagant racing bills. Next to it, a turbocharged, all-wheel-drive 323 GTX demonstrates that Mazda could engineer fun into even their lowliest of econoboxes. A row of street-driven RX-7s includes a pace car, as well as the only left-hand-drive Spirit R – a special edition produced for the right-drive Japanese market – ever made. Strictly speaking, this last one might not be considered part of the final run of RX-7s, as it was specially built at the factory for an MNOA executive. It has lightweight Recaros, upgraded brakes, specialised engine tuning and bespoke aerodynamic elements. It is also – at least during this visit – broken. Next to the RX-7s are a few open spaces, evidence of some missing cars. These are currently upstairs, and are perhaps better loved than any other machines down below. This year is the 25th anniversary for the Miata – also marketed as the MX-5 and Eunos Roadster – the best-selling sports car the world has ever seen. It conveys all the fierce joy of the racing cars down here, but in a tidier, admittedly more reliable little package suited to public roads. Cleaned up and drained of fuel, the cars are being readied for the 2014 New York auto show, where press previews begin 16 April. Among them are the original cars displayed at the model's 1989 Chicago auto show debut – one red, one blue – that are respectively the 14th and 15th Miatas ever produced. A supercharged concept called the Super20 has just returned from a trip to Alaska, where it cavorted with a local Miata owners club. Further on, there are the concepts: a sleek third-generation Miata Spyder, a flared yellow first-generation car that sat alongside the stock originals at Chicago, and a one-off fastback coupe. An original clay model of the Miata. Southern California is the birthplace of the Miata, where the original design was carved in clay, and where the suspension and handling were refined. An original model touched by the hands of designer Tom Matano is down here, too. Among the New York-bound Miatas is a white, slightly ratty, showroom-stock racing car. Reaching into the cockpit, Barnes pulls out the original Sports Car Association of America logbook and flips it to the first page, dated 23 September 1989. This car also shared the Chicago stage in 1989 with the red and blue cars, but would go on to podiums of another kind. Compared to the mighty beasts that sleep below, it is a simple thing, but no less battle-hardened. It makes, in fact, a nice spirit animal for Mazda as a whole: small, energetic, quietly obsessed with going fast. Such traits do not lend themselves neatly to a museum format. But this is a paddock, remember, and its occupants were born to gallop – even right through retirement.

-

- 2

-

-

- mazda

- motorsports

-

(and 6 more)

Tagged with:

-

SINGAPORE'S Central Provident Fund (CPF) system ranks top among similar social security systems in Asian countries, but it is Denmark's well-funded pension system which has emerged the best globally. The 2014 Mercer Melbourne Global Pension Index identified Singapore's CPF is a "sound structure, with many good features, but has some areas for improvement that differentiates it from an A-grade system". The Singapore retirement system continues to score a grade of B, but is expected to be upgraded once shortcomings are addressed, said Neil Narale, Mercer's Asean Retirement Business Leader. "The lack of tax-approved group corporate retirement plans and retirement savings for non-residents continues to isolate Singapore from other highly-graded countries on the global scale," he said. http://www.globalpensionindex.com/country-summaries-2/singapore/ http://www.businesstimes.com.sg/government-economy/singapores-cpf-system-ranked-top-in-asia-denmarks-system-leads-globally-mercer

- 44 replies

-

- 1

-

-

- cpf global ranking denmark

- pension

- (and 7 more)

-

Aleksandar Duric's Letter: Thank you very much Singapore Aleksandar Duric will retire on Oct. 31 having scored 376 goals and winning 16 domestic club titles at 15 clubs. "It is hard to put my thoughts into one letter, but I needed to bid a proper farewell to my football family. The Singapore football family. Friday will be one of the saddest days of my life. It is all coming to an end. A beautiful dream that I could never have imagined growing up as a boy from a small town in Doboj, Yugoslavia. The moment the final whistle goes, I know the memories will start flooding into my mind, the hundreds of matches I played, the different goals I scored and the heartbreaking moments when my team lost. ALEKSANDAR DURIC PROFILEBorn: Aug. 12, 1970 Position: Striker Total domestic club football games played: 519 Total domestic club football goals: 376 International caps: 53 International goals: 24 I still remember when I first set foot in Singapore in 1999, I reported for training with Tanjong Pagar United FC at Queenstown Stadium and I asked one of my new teammates, "OK, so this is the training ground, so where is the stadium we play at?" He stared at me blankly for a minute and we both couldn't stop laughing at my silly question that I am still embarrassed about today. Never in my wildest dreams would I have imagined that, 16 years later at the young age of 44, I will end my career in the very same league with 321 goals, 16 domestic titles and eight individual awards. While my club career was important to me, my proudest and biggest moment was when I received my Singapore citizenship in October 2007 and was called up by Coach Raddy [Radojko Avramovic] for the national team at the age of 37. I scored both goals in my first game against Tajikistan in a 2010 FIFA World Cup qualifier on my debut. It still sends shivers down my spine when I talk about it now. That will be etched in my mind as the proudest moment of my life, apart from the birth of my kids Isabella Nina, Alessandro Hugo and seeing my adopted son Massimo Luca Monty growing up each day. Duric with his three kids Bella, Alessandro and Massimo when he won the S.League title back in 2013 . I have enjoyed every single moment of this career and I cannot tell you how much emotions I have gone through. The sadness of losing league titles, to the joy of lifting my first ASEAN trophy with the Lions in 2012. Having played for 15 different club sides, my 24 goals in 53 appearances for the national team will be my biggest take away from the game. I sweat blood and tears for Singapore, and I would give everything to do it all over again. All I want now is for somebody to remember me as a decent player, who was humble both on and off the pitch, who tried my very best and gave everything to the clubs I played for and the pride I had wearing the Singapore jersey. For the rest of my life, I will live another dream. The dream of giving back to the country that has given me so much. That is why I decided to adopt Massimo and I will now focus on helping Southeast Asian kids fulfill their dreams of playing professional football, scoring goals like I did and have a better life. Please forgive me if I cannot hold back my tears on Friday night, but the emotions I am going to experience will be something I cannot describe. It is hard to sum it all up in one sentence but I thank each and every one of the coaches, players and fans who have treated me like one of their own. For making my life so beautiful and rich in memories. Now it is time for me to take my seat in the stands and cheer Singapore on and I am excited to finally have the chance to chant with the fans and do the Kallang wave as a die-hard supporter. So with this, I sign off my football playing career and I ask of you to remember me, the tall old striker who loves Singapore, my home. Thank you S.League, thank you Singapore and thank you my fellow Singaporeans. From a decent striker, a loving father and most importantly, a son of the Lion City." Aleksandar Duric Duric was speaking to ESPN FC's Kelvin Leong

- 34 replies

-

- 5

-

-

- aleksandar duric

- s-league

-

(and 5 more)

Tagged with:

-

hmmmm........ can consider ... Yahoo news: 11 Reasons to Retire in Portugal's Algarve Portugal's Algarve, home to more than 100,000 resident expat retirees, could be the best place in the world to retire that nobody's talking about. Particularly appealing are the two municipalities of Silves and Lagoa that are situated slightly west of the center of Portugal's southernmost province. In these two spots, you can enjoy the best the region has to offer, from medieval towns and fishing villages to open-air markets, local wine and some of Europe's best sandy beaches. This is a land of cobblestoned streets, whitewashed houses with lace-patterned chimneys and everywhere there are fig, olive, almond and carob trees. Here are 11 reasons the Algarve qualifies as one of Europe's top retirement havens: 1. Great weather. This region enjoys one of the most stable climates in the world and 3,300 hours of sunshine per year, meaning more sunny days than almost anywhere else in Europe. As a result, the Algarve has a longstanding reputation as a top summer destination among European sun-seekers and a top winter retreat for those looking to escape Northern Europe's coldest months. It's a popular holiday destination among the Portuguese year-round, and the Spanish love the region's wilder western coast. 2. Safety. Portugal ranks as the 17th safest country in the world. Violent crime is rare, and petty crime is limited to street crime during the busy tourist season. 3. Good infrastructure. Portugal and the Algarve have enjoyed important infrastructure investments, specifically in the country's highway network and airports. This could be a great base for exploring all of Europe and northern Africa. 4. International-standard health care. Medical tourism is a growing industry in the region, particularly if you are interested the aesthetic, hip replacement and dental specialties. 5. Golf. The region boasts 42 courses in less than 100 miles and is generally recognized as a top golfing destination in continental Europe, and some would say the world. 6. Great beaches. The Algarve's 100 miles of Atlantic coastline is punctuated by jagged rock formations, lagoons and extensive sandy beaches, many awarded coveted blue flags from the European Blue Flag Association. The water off these shores is azure and the cliff-top vistas are spectacular. Most beaches have lifeguards during the summer season. Many have restaurants or snack bars, sometimes open only seasonally. 7. Affordable cost of living. The cost of living in Portugal is among the lowest in Western Europe, on average 30 percent lower than in any other country of the region. A retired couple could live here comfortably but modestly on a budget of as little as $1,500 per month. With a budget of $2,000 per month or more, you could enjoy a fully appointed lifestyle in the heart of the Old World. 8. English is widely spoken. Thanks to Portugal's strong historic and cultural links with England, English is widely spoken in the country in general and even more so in the Algarve, the country's main tourist draw. Retired here, you could get by without learning to speak Portuguese if you wanted to. 9. Healthy living and eating. The Portuguese are the biggest fish eaters per capita in Europe, and fresh fish of great variety is available in all the ever-present daily markets. In addition, the abundance of sunshine in this part of the world means an abundance of fresh produce is also available in the local markets. 10. Retirement income is not taxed. Recent legislation allows resident foreign retirees to receive pension income in the country tax-free. The law also provides for reduced taxation on wages, intellectual property, interest, dividends and capital gains. 11. Severely undervalued property market. Real estate in Portugal is undervalued and among the most affordable in Europe. Further, Portuguese real estate has one of the most favorable price-to-rent ratios (a measure of the profitability of owning a house) and price-to-income ratios (a measure of affordability) in the region. What that means is that housing is cheaper to buy and investors can make more money from rentals than in many other European countries. Kathleen Peddicord is the founder of the Live and Invest Overseas publishing group. With more than 28 years experience covering this beat, Kathleen reports daily on current opportunities for living, retiring and investing overseas in her free e-letter. Her newest book, "How To Buy Real Estate Overseas", published by Wiley & Sons, is the culmination of decades of personal experience living and investing around the world. link: https://sg.finance.yahoo.com/news/11-reasons-retire-portugals-algarve-135758354.html

-

http://www.tremeritus.com/2014/03/08/alternative-daily-news-72-sg-falls-by-13-in-retirement-index/ Alternative daily news (72) SG falls by 13 in retirement index March 8th, 2014 | Author: Contributions Sunday Times; 02 March 2014; Pg 37. I refer to the article “S’pore no longer one of best 30 places for retirees” (Straits Times, Mar 2). S’pore drops 13 places? It states that “it slides from 28th to 41st on index. Dropped to 125th for income equality? Singapore ranked a poor 125th spot for income equality, worse than the previous year’s 117th place” - More than 200,000 full-time, part-time and self-employed persons earn less than $1,000 a month. I estimate about 400,000 and 600,000 earn less than $1,200 and $1,500 respectively. Quality of life dropped to 75th? “Singapore’s quality of life index, which measures the level of happiness and fulfillment in society as well as environment factors, dropped to 75th place from 39th last year. Health index dropped to 59th? It also dipped in the health index, from 56th spot last year to 59th this year… high levels of out-of-pocket health expenditure” Highest share – private healthcare expenditure? - At about 67% – our private health expenditure is the highest among developed countries. Level of happiness? According to the Mercer’s 2012 Cost of Living Survey, Singapore is the 6th most expensive city out of 143 cities in the world – Singaporeans earn the lowest wages among the high-income countries – we also work the longest hours in world - Singapore has been ranked as having the 2nd highest work stress in Asia - among the the lowest fertility in the world – out of 224 countries- have been ranked the 2nd lowest libido as compared to over 40 countries. Surveys such as the Gallup rank Singaporeans as having the least positive emotions, most emotionless and least optimistic, – the Happy Planet Index ranks Singapore at 90th – most unhappy, and the World Happiness Report 2013 ranks singapore as the 126th (most unhappy) and 144th (most emotionless) - Singaporeans are second least likely to help a stranger, out of 135 countries. Leong Sze Hian Leong Sze Hian is the Past President of the Society of Financial Service Professionals, an alumnus of Harvard University, Wharton Fellow, SEACeM Fellow and an author of 4 books. He is frequently quoted in the media. He has also been invited to speak more than 100 times in 25 countries on 5 continents. He has served as Honorary Consul of Jamaica, Chairman of the Institute of Administrative Management, and founding advisor to the Financial Planning Associations of Brunei and Indonesia. He has 3 Masters, 2 Bachelors degrees and 13 professional qualifications. He blogs at www.leongszehian.com.

- 10 replies

-

- 2

-

-

- leong sze hian

- alternative

-

(and 4 more)

Tagged with:

-

http://www.bloomberg.com/news/2013-04-18/w...re-remodel.html Singaporean men live an average 20.8 years after retirement while their female counterparts have 25.6 years, according to the Bloomberg Sunset Index. The measure, which places Singapore ahead of France and South Korea, estimates the age at which residents leave the workforce and subtracts this from their life expectancy. A 2012 Bloomberg study on the healthiest nations awarded the highest grade to Singapore out of 145 countries. Average of 20 years for men is very long time to live without working, and for women it's longer! Require lots and lots of cash to meet an appropriate standard of living.

-

Downgrade when retire For the avg singie, this is your future when u retire: "ELDERLY Singaporeans would get more cash upfront, and need to put in less to top up their savings accounts, if they choose to downgrade to a smaller flat or sell the tail-end of their lease back to the Housing Board." When u retire, instead of a nice spacious place, u may end up in a smaller n smaller place. Quality of living indeed! The other option is also known as reverse mortgage, which garmen wld rather u do coz its cheaper than SERS, coz if they SERS your flat, they have to give u $ to move into another choice new flat, so they cant sell that new flat w a new long term to someone else. In other words, theyre encouraging singies to stop waiting for SERS.

-

Bernie Ecclestone feels that Schumacher should not have returned

SYF77 posted a blog entry in MyAutoBlog

[extract] F1 boss, Bernie Ecclestone, feels that Michael Schumacher- 3 comments

-

- motorsports

- formula 1

- (and 8 more)

-

No need to save cash from your monthly disposable income for retirement anymore...woohoo govt say wan no need multiple income streams, investment etc life is so simple i got it wrong all this while... better start spending since CPF can provide me 71% of my pre retirement income even after paying for housing YOUNG Singaporeans starting work today will have enough savings in their Central Provident Fund (CPF) accounts to retire comfortably in their golden years, says a study commissioned by the Manpower ministry. They would have accumulated CPF savings that will give them a comfortable level of income in retirement - a level equal to a large part of their pre-retirement earnings, it says. Deputy Prime Minister Tharman Shanmugaratnam, giving a preview of the findings, said, however, that the CPF balances of older workers will be inadequate, although most of these individuals would have gained from the rise in the value of their homes, courtesy of government subsidies, earlier withdrawal of CPF savings and economic growth. "Our strategy is to help them monetise the values of their homes in retirement if they wish to," said Mr Tharman, who is also Finance minister. He was delivering a keynote address at the opening of the Singapore Human Capital Summit conference. The study he was referring to was done by National University of Singapore professors Chia Ngee Choon and Albert Tsui. In their study into whether the CPF system adequately meets retirement needs, the professors computed what economists call the income replacement rate (IRR), which is the ratio of retirement income to pre-retirement earnings. Using all CPF savings acccumulated by a worker up to the age of 65, including savings above the CPF Minimum Sum which the worker can withdraw at age 55, they found an IRR of 71 per cent for a median male worker who starts working today. The female median worker's IRR is 63 per cent. These IRRs factor in only the cash savings in the CPF; they exclude the benefits the worker gets from owning a home. "These IRRs are within the recommended range by the World Bank, which is between 53 per cent and 78 per cent," Mr Tharman said. "They are also comparable to those seen in pension systems in many developed countries." The equivalent IRR in the median country in the OECD, the league of rich nations, is 66 per cent of pre-retirement earnings, while the average among the OECD countries is 72 per cent. Mr Tharman pointed out that Singapore's IRR is even higher when its near-universal home ownership - under which homes are fully paid by the time workers hit retirement age - is taken into account. "By not having to pay for rent, cash is freed up for other living expenses in (the workers') old age," he said. With workers who are already older, however, he acknowledged that their CPF balances will be insufficient for three reasons: their wages were much lower in the past; they were required to set aside less in their CPF retirement account; and the fact they could use much of their CPF savings for housing. The study found the IRR to be lower for higher-middle earners because, as Mr Tharman pointed out, the CPF system is designed to meet the retirement needs of workers in the middle- and lower-income groups. High-income earners have private savings. Workers in the lower income group, in fact, have an IRR of 81 per cent of pre-retirement income. If the supplements of their wages through the Workfare programme are included, the IRR is even higher - 93 per cent. Mr Tharman said: "The results of the study are an important validation of the CPF system. The refinements we have made to it over the years have ensured that the vast majority of young Singaporeans will receive adequate payouts in retirement." He pointed out, though, that it still falls to individuals to take responsibility and save, and for employers to take the responsibility of providing good jobs, sharing productivity gains fairly and keeping older workers employed. The fifth edition of the Human Capital Summit is hosted by the Human Capital Leadership Institute, the Ministry of Manpower and the Singapore Workforce Development Agency. At the conference yesterday, Acting Manpower Minister Tan Chuan-Jin presented this year's Asian Human Capital Award to digital-security specialist Gemalto and global supply chain manager for agricultural products Olam International for their people-management practices. MTR Corporation, Tata Consultancy Services and Toyota Motor Philippines Corporation were named Special Commendation Prize Winners.

- 70 replies

-

Received a call from DBS relationship manager touting a new account type which is like an endowment fund. Like to check your opinion on this, seems ok to me. 8 years monthly recurring deposit of a fixed amount say 3000 per mth. After 8 years invested amt is abt 288k. First Payout will be on 15th years, paying the monthly recurring amt x 12 x 10. Using the example of 3000 payout is 360000. On retirement age 65 the second payout of your principal. In summary, investment after 8 years = 288000 First payout after 15 years = 360000 Second payout at 65 years = 288000 Returns of 646 k with 288k investment Your views?