Search the Community

Showing results for tags 'POSB'.

-

Let's start with this https://www.straitstimes.com/singapore/courts-crime/ocbc-bank-customer-lost-120k-in-fake-text-message-scam-another-had-250k-stolen Young couple lost $120k in fake text message scam targeting OCBC Bank customers SINGAPORE - It took a man and his wife five years to...

-

Both credit cards also got rebate system. I have been using Citibank Dividend cards for few years. Enjoying quite good rebates from them regularly. Recently backside itchy go and apply the POSB Everyday card. Wanna ask anyone who is familiar on both cards, which cards give more rebate...

-

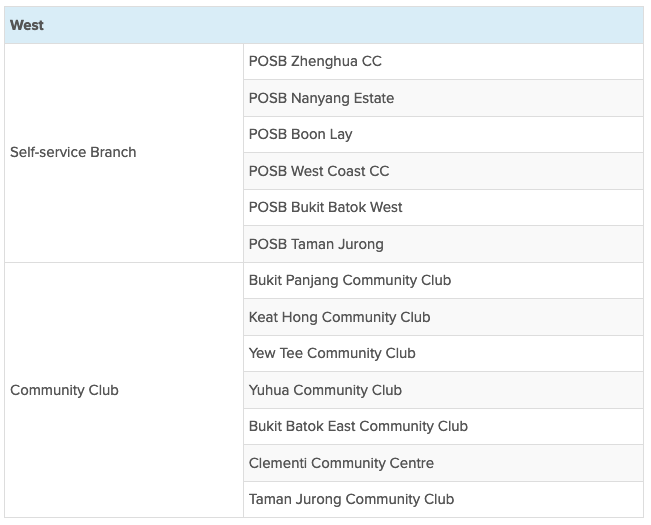

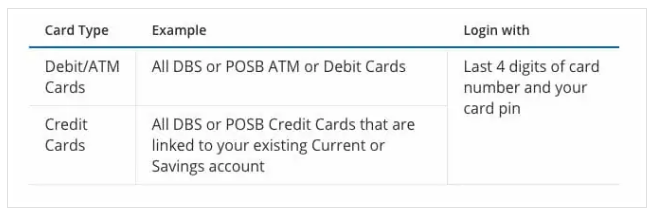

Getting new dollar notes for red packets? This year, there are a total of 41 POSB & DBS pop-up ATM locations and self-service branches islandwide you can withdraw new notes from. Two ways to get them There are a couple of ways you can get your new notes this year. The first is from pop-up...

-

The Straits Times www.straitstimes.com Published on Jan 5, 2012 http://www.straitstimes.com/print/Breaking...ory_752199.html Unauthorised withdrawals from DBS/POSB accounts By Robin Chan DBS Bank is investigating a potentially large scale bank fraud, after a series of unauthor...

- 78 replies

-

Covid-19: POSB app crashes briefly on Apr. 14 as govt credits S$600 payout to S'poreans source: https://mothership.sg/2020/04/solidarity-payment-posb-app-crash/ Singaporeans will be receiving a S$600 payout credited directly in their bank accounts on Apr. 14. And it seems like S...

- 32 replies

-

- 5

-

-

.png)

-

- posb

- solidary fund

-

(and 1 more)

Tagged with:

-

http://www.asiaone.com/News/Latest%2BNews/...413-339606.html I personally do not use POSB, I find that it not only inconvenience low-income earners but also to everyone else especially when you need to buy something small. When a lot of ppl wanna pay for a bowl of $3 noodles with a $50 note how...

-

New rule wef 14 April '13, overlimit fee of $40 will be imposed if the total o/s balance exceeds the credit limit at any time. Saw this in the "Specially for you" page which people normally don't read/pay attention to.

-

My habit has been not to redeem the rebate amount when using my POSB Everyday card for petrol payment. Just realised the other day that it has accumulated to close to $1000! Working backward, I would have pumped $1000/6% = $16k of petrol to accumulate this rebate amount! Just curious anyone...

- 76 replies

-

- 4

-

-

- just for fun

- posb everyday card

-

(and 5 more)

Tagged with:

-

My DBS/POSB ATM card was disabled by them on monday 14/05. Will share my long story later. Anyone else kanna?

-

Had a discussion on HWZ regarding this. is the $50 min at most popular POSBs these days really needed? and whats their main purpose?

-

channelnewsasia LATEST: DBS Bank says 400 cases of unauthorised withdrawals found. Half a million dollars in compensation expected. The bank has identified two ATMs at Bugis that were compromised, situation is contained.

-

http://www.dbs.com/posb/deposit/notice/rev...px?pid=xs402121 knn. see the new rates. just when we thought they were already low...

-

Heard from a friend that it's closing down despite newly renovated recently.... wonder y renovate if it's closing down... they have too much $$?? he's in Potong Pasir SMC btw... http://locator.dbs.com/index.php/branching...ils/37/DBSPOSB/

- 9 replies

-

- POSB

- Macpherson

-

(and 3 more)

Tagged with:

-

Hi all, a overseas friend is in town and needs to use the bank. ATMs are no good for him. Anyone knows if there are any DBS/POSB that are open on Friday, Deepavali ? Appreciate any replies . .. . Thanks

-

Notice this transaction code in my POSB account. Anyone out there know what type of transaction it's.

-

- POSB

- Transaction

-

(and 2 more)

Tagged with:

-

Didn't know that this is happening, so got pissed off by the AXS machine. Keyed in my laundry list of bills as I do every month, only to end up being told that my OCBC ATM card is not accepted anymore. Called up the customer service line and was informed that they are changing the machines to "D-Pay...

-

Read today ST Forum Page and was amused by one letter send to ST Forum: Quote: "Come Save with POSB but pay $4.50 to deposit coins" "Complainant's son was happy to received a piggy bank in the form of a 'can' from POSB a few months ago. It was distributed in his school, together with a book...