Search the Community

Showing results for tags 'Income'.

-

Anyone know what's the max CPF relief that a Singaporean can get for YA 2012? The information on IRAS website is kinda confusing. So to estimate my YA 2012's CPF relief, i am just using my YA 2011 Notice as a gauge. (i guess my actual CPF relief for YA 2012 shd be higher since my earning is higher yr-on-yr). Also, if our ICT liability is over, that means we are no longer considered as "NSMan" right? Now, trying to bring down my personal income tax bracket, i am pondering if i shd be: 1) SRS: at least i can still withdraw before retirement but subj to 5% penalty and be brought to tax, and can use for investment. Helps if i really need cash all a sudden. 2) CPF top-up (but cant remember gng to which accounts): generally earn higher interest rates, but bane is locked down till retirement. No way out. Any experts out there to advise, or pple who has gone through the same route and have experience to share?

-

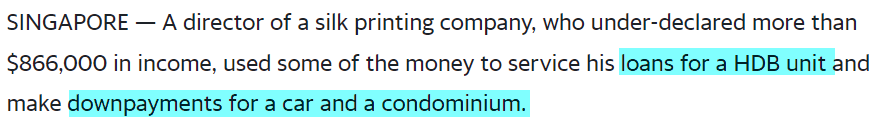

with that kind of income downpayment this downpayment that ... sure kena red flag may be he can brag he bought Bitcoin at $1,000 and sell at $65,000 ... confirm TAX FREE ! https://sg.finance.yahoo.com/news/director-jailed-for-underdeclaring-over-866000-income-used-money-for-hdb-loans-115005975.html

- 34 replies

-

- 3

-

-

- difference

- between

-

(and 4 more)

Tagged with:

-

Old article but do you agree? https://www.quora.com/Which-citizenship-is-the-hardest-to-obtain/answer/Ravindra-357 Here are eight countries where it's most difficult to become citizen : 1- Vatican City You can become a citizen if you are a cardinal living in the Vatican City or Rome, or if you live in Vatican City because you are an official worker of the Catholic Church. 2- Bhutan You can apply for the citizenship after living in the country for 20 years & you have to meet a list of requirements which includes no record of speaking or acting against the king or country. 3- Qatar If you have been a legal resident of Qatar for 25 years without leaving the country for more than two consecutive months, you can apply for the citizenship. Qatar only naturalizes about 50 foreigners a year. 4- Kuwait After living in Kuwait for 20 years or 15 years for citizens of other Arab countries, you can apply for the citizenship. But you have to be muslim by birth or converted. If you are converted, you must have been practicing for five years & have to speak Arabic fluently. 5- Liechtenstein If you want to become a citizen, you have to live in Liechtenstein for at least 30 years or if you are married to a Liechtenstein citizen & already lived in the country, then the time period is shortened to five years of marriage. 6- United Arab Emirates If you want a citizenship of UAE, you must have legally resided in the country for 30 years. Arab citizens from Oman, Qatar & Bahrain can apply for citizenship after three years of residency. Arabs from other countries are eligible for citizenship after seven years of residency. 7- Switzerland According to the new law of Switzerland, you must have to lived in the country for 10 years & have a working permit called a C permit. The C permit allows you to live & work in the country. 8- China The law of China allows the foreigners to become citizen of the country if they have relatives who are Chinese national, have settled in China. If you don’t have Chinese relatives in a country, your chances of becoming a Chinese citizen are less. https://www.quora.com/Which-country-gives-permanent-residency-the-fastest/answer/Ravindra-357 Here are five countries in which establishing permanent residency is easy : 1 - Belgium If you live in Belgium for five continuous years, you can apply for permanent residency. Becoming a citizen adds to that the ability to leave the country for more than two years at a time 2 - France You can get permanent residency or apply for citizenship after living in the country for five continuous years. A permanent residency is renewed after ten years that allows you the right to education, healthcare, and worker's rights at jobs, but doesn't allow you to vote. Obtaining France’s citizenship also makes you a citizen of the EU. 3 - Panama Panama is also very welcoming to those who are wealthy and those who want to invest in deforestation programs. Citizenship can only be obtained after five continuous years of residency or three years for foreign spouses of Panamanian citizens. 4 - Singapore Singapore is one of the easiest countries in which a permanent residency has been estabilished. All you have to do is to apply for an employment pass, be the spouse or child of a Singapore citizen, plan to make an investment in the country, or you just have to be a permanent resident of the country for two or more years. 5 - Brazil If you plan to invest at least $50,000 in a business or real estate of the country, you can apply for an Investor’s Visa. Or you must have resided in the country continuously for 10 to 15 years for getting the permanent residency.

- 30 replies

-

- 2

-

-

- citizenship

- easy

- (and 11 more)

-

https://www.straitstimes.com/singapore/household-incomes-rose-in-2022-income-inequality-fell SINGAPORE – Median household income grew in 2022 and income inequality fell when compared with 2021, figures released by the Singapore Department of Statistics (SingStat) on Thursday showed. Among resident employed households, monthly household income from work grew by 6.1 per cent in nominal terms, or before adjusting for inflation, from $9,520 in 2021 to $10,099 in 2022. Median monthly household income from work rose 0.2 per cent in real terms, or after adjusting for inflation, in 2022. Household income from work includes employer Central Provident Fund (CPF) contributions. From 2017 to 2022, median monthly household income from work of resident employed households increased 2.9 per cent cumulatively, or 0.6 per cent per annum in real terms. Such households have at least one employed person, and the household reference person – previously referred to as the head of household – is a Singapore citizen or permanent resident. Taking into account household size, median monthly household income from work per household member rose from $3,027 in 2021 to $3,287 in 2022, an increase of 8.6 per cent in nominal terms, or 2.6 per cent after adjusting for inflation. From 2017 to 2022, median monthly household income per household member grew by 11.9 per cent cumulatively, or 2.3 per cent per annum in real terms. Rise in income for all but top earners Households across most income deciles saw increases in average household income from work per household member after adjusting for inflation. In 2022, the average household income from work per household member of resident employed households in all income groups rose in nominal terms, with the increases ranging from 5.3 per cent to 15.6 per cent. After adjusting for inflation, households in the first nine deciles saw real income growth of 1.1 per cent to 10.1 per cent, while those in the top decile saw a real income decline of 1.3 per cent. Between 2017 and 2022, the average household income from work per household member of resident employed households in the first nine deciles rose 1.5 per cent to 3.0 per cent per annum in real terms, while that in the top decile recorded a decline of 0.4 per cent per annum in real terms. The decline experienced by the top decile was because of a larger increase in household size from 2.26 in 2021 to 2.34 in 2022, compared with households in the other deciles. This, coupled with higher inflation experienced in 2022, contributed to the decline in their real household income in 2022. More money distributed through government schemes Resident households, including households with no employed person, received $5,765 per household member, on average, from government schemes in 2022. This was higher than the $5,257 received in 2021, due to the one-off and transitionary measures in 2022, as well as enhanced schemes, to cushion the impact of the goods and services tax (GST) rate increase and higher inflation on cost of living, said SingStat. Resident households living in one- and two-room Housing Board flats continued to receive the most money from the Government. In 2022, they received $12,189 per household member, on average, from government schemes, close to double the amount received by resident households living in HDB three-room flats. The Gini coefficient based on household income from work per household member – before government transfers and taxes – fell to 0.437 in 2022, from 0.444 in 2021. The Gini coefficient is a measure of income inequality. A Gini coefficient of zero occurs when there is total income equality, and a coefficient of one means there is total inequality. After adjusting for government transfers and taxes, the Gini coefficient in 2022 fell from 0.437 to 0.378. “This reflected the redistributive effect of government transfers and taxes,” said SingStat. Nonetheless, this is still slightly higher than the Gini coefficient of 0.375 in 2020, which was the lowest on record. The report, Key Household Income Trends, 2022, is available on SingStat’s website.

-

https://www.straitstimes.com/singapore/courts-crime/the-dollars-and-sense-of-pegging-fines-to-an-offenders-income Peg the fine according to the income? My answer ? No! What about you ?

-

https://www.channelnewsasia.com/news/singapore/164-000-singaporean-adults-living-in-private-housing-have-no-11513318 Hmm... pity, empathy or disgust?

-

Hello peeps, anyone here looking to buy oversea property? Or anyone buying 1 in Melbourne? I am looking to get one apartment and im looking at Melbourne as it is more of a safe haven to invest in IMO. The price is pretty steep, capital growth is not that fantastic but in long term holding, I think it should be an uptrend. Anyone has any advice of getting one in Docklands area? Is it overpriced? This one looks like it is just beside CBD wor. Any expert here with advice? https://investoprop.com/melbourne-cbd-apartments-for-sale/ This is one is the one in Docklands. https://investoprop.com/new-developments-projects-melbourne-southbank/ And this one in Southbank.

- 16 replies

-

- 1

-

-

- melbourneproperty

- docklandsproperty

- (and 7 more)

-

I remember saw some pamphlet from some bank saying paying income tax with interest free installment but forget which bank. Anyone any idea? Don't wish to pay by GIRO.

-

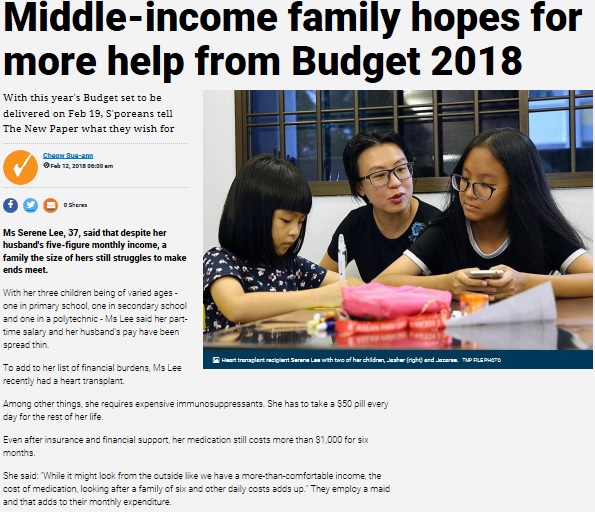

http://www.tnp.sg/news/singapore/middle-income-family-hopes-more-help-budget-2018 Really not enough?

-

would you sacrifice everything else to own a car? http://www.channelnewsasia.com/news/cnainsider/low-income-and-owning-a-car-why-9449930

- 538 replies

-

- 3

-

-

- low income

- own

-

(and 3 more)

Tagged with:

-

Had been driving B&B cars for past 15 over years, now just feel like buying a new better car price around $220k. Financially ok, of course much better than 15 year ago when i started first my job. Now married with 2 kids, no house loan, miscellaneous loan, no expensive holiday, no expensive dinning. Annually combined income 230k(PA), very stable job both wife and myself foresee our income should reach 300k(PA) at 5 years time easily. Feeling unsure now, will it considers "over stretching" for someone like me to buy a car at such price. Can't decide, maybe you guys can help and share some of your view. What do you think?

-

Just wondering , with the property going up north , at what combined income do you think an average Singapore can afford a Pte property > $1.2m comfortably ? EC > $1m for combined income of 12k is it too pushy / risky ?

-

no more sponsor for diaper, milk powder, plastic surgery, travel packages, etc.....

-

Hi MCF members! SGX has an upcoming free admission event on Saturday 26 November, 10 AM - 1 PM SGX Market Outlook 2017: Finding Income and Managing Risk Forum More info: http://notice.shareinvestor.com/email/20161126_sgx/index.html This is an interesting event as the current financial market is highly volatile. Many of your may want to hear and learn the various ways to manage risk and earn a decent income from investment in 2017. Click here to register. First 100 to arrive early for registration with receive a mystery gift!

-

Was planning to get a 5-room BTO this year as my current flat will MOP soon. Was thinking that the new income ceiling came in just nice... until my boss just suddenly gave a pay increment which puts my wife and me just a couple of hundred of dollars over the salary ceiling for BTO. Can I still appeal and has anyone in my circumstances successfully appealed to HDB before?

-

Only median income households in 25 largest US cities can afford a new car. http://www.autoblog.com/2013/03/03/househo...rage-new-car-p/ To quote "The rule states that a buyer should be able to offer a down payment of at least 20 percent, incur financing for no more than four years and endure a principal, interest and insurance totaling up to no more than 10 percent of household income. " Where does applying that rule on Singaporean households put us?

-

if your salary is $2,601/mth ... you are upper income liao then $5K is what? $10K is what? $20k is what? wait for it ... $100K/mth is what????? but based on MCF standard $5k is the new poor wor ... MediShield Life: Govt accepts proposals, will provide almost S$4b in subsidies

- 154 replies

-

- 3

-

-

- medishield

- income

- (and 4 more)

-

Do we need to declare each and every dividend received from stocks? Some indicated as "LESS TAX" , other don't know what Qualifying individual, beneficiary..... layman term can or not?

- 26 replies

-

- income tax

- dividend

-

(and 2 more)

Tagged with:

-

TUITION TEACHER !!!! Work 40-50hrs a week for an average of $800kpa!! Huat ah! Source: straits times 9 Nov 2014 Plse report your taxes hor, all you tuition teachers out there. Especially those driving luxury cars. Be careful.. Muayhahahahaha

- 38 replies

-

- 1

-

-

So I was thinking, what is a reasonable amount to spend on a car? Let's take as a percentage of household income to standardise. If a household combined monthly income is $10,000, annual income $120,000, and they buy a Honda Jazz with annual depreciation $10,000 (http://www.sgcarmart.com/new_cars/newcars_overview.php?CarCode=11531), it means they are spending 10/120 = 8% of their income on the car, excluding petrol etc. Do you think this is reasonable? How much would you spend on a car?

-

http://www.channelnewsasia.com/news/singapore/more-low-income/1385774.html I think personally this is a good policy to help low income especially in this day & age. Especially for the children. Wonder what the naysayer comments will be... lol.

- 61 replies

-

- 9

-

-

- low income

- internet

-

(and 4 more)

Tagged with:

-

I read ST today and they said the top 10% of household, the average monthly income is $22k. The average annual income per household member of private property owners is $54k. The average of HDB 4 rooms and above is $21.8k. For smaller HDB flat owners, the number is even smaller. But the funny thing is, the national AVERAGE is $25k. Does this mean if you stay in HDB you are below average in income? interesting article actually.

-

wat is the % of monthly income for car?

- 11 replies

-

http://www.iras.gov.sg/irashome/default.aspx Remember to do your declaration by 18 April hor........ Those lich MCFers, please don't under declare hor.....

.png)