Search the Community

Showing results for tags 'Dividend'.

-

Both credit cards also got rebate system. I have been using Citibank Dividend cards for few years. Enjoying quite good rebates from them regularly. Recently backside itchy go and apply the POSB Everyday card. Wanna ask anyone who is familiar on both cards, which cards give more rebates and provide more benefits?

-

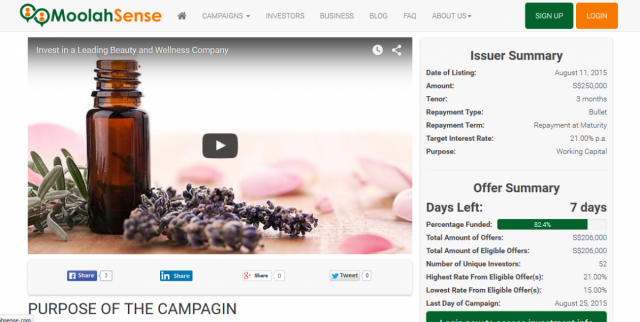

Came across this link in my facebook. https://moolahsense.com/running-campaign.php?company=Beauty Clicked, and woots... a bond that promises 21% returns per year. And already raised 82% of its required capital?? My first thoughts... why does the company raising the funds want to give 21% interest? Loan sharks is only 24% afterall!! 2nd thoughts. Deal sounds too good to be true for the investors. Damn bloody risky. But with just a simple video and wall of text, they can get $200K? S'poreans money very easy to take.

- 107 replies

-

- 2

-

-

- crowd funding

- moolahsense

-

(and 5 more)

Tagged with:

-

Is the addn 3% off for ESSO using dividend card still on? If it is not, I am thinking of switching to DBS ESSO.

-

Citibank DIVIDEND Card how much discount with ESSO?

Quantum posted a topic in General Car Discussion

Hello all, I thought Citibank DIVIDEND Card can get 18.3% discount petrol at Esso, but the counter casher only agreed to give 14%, and said another 5.3% subject to site promotion do you have same experience? -

Do we need to declare each and every dividend received from stocks? Some indicated as "LESS TAX" , other don't know what Qualifying individual, beneficiary..... layman term can or not?

- 26 replies

-

- income tax

- dividend

-

(and 2 more)

Tagged with:

-

Pls take note. forums.hardwarezone.com.sg/credit-cards-line-credit-facilities-243/citibank-dividend-card-cashback-downgraded-3800370.html

-

Just realised the other day tat if i buy <$50 of petrol on my citi dividend card, i only get 0.5% cashback and not the 5% as i expected. Anybody can verify this? (see the attached citibank chart's fine print at the bottom)

-

I'm new to this... got a turquoie color paper from Noble Group, what what script dividend and need to response... what should I do ah? Whole paper is wordings, read until I

-

Hi all, Just want to ask those who use citibank dividend card and pump at esso stations if they also use the esso mobil privilege card. Some say that there's additional discount but I don't know how it works lei. Normally I use the dividend card and get 14.5% (10% + 5% rebate off total bill). - Does esso mobil privilege card give additional discount? - Do I pay with dividend card or with esso mobil privilege card? - What's the best card to use for esso stations? Would appreciate if any esso users can share.

-

For those using Dividend Card with Esso Mobil Card at Esso stations for the super high discounts, please remember to double-check the Dividend$ rebate in your monthly statement... Realised since last month statement that the computation for the earned Dividend$ is lesser than what should have been given, not just petrol station (5%) but also other spendings (eg: 2% dining, etc).. Excuse was the different/unrecognized merchant charge codes used by the merchants (but I told them this shouldn't be my problem right)~ Called them up last month n promised to rectify everything incl all past months' errors, but yet this month statement reflected the same problem and no adjustments from previous months' errors Called up again n promised to rectify... So heads up for those on this card n don't assume everything is calculated correctly

-

gahmen owes my wife and i $550 Might be an honest mistake, so I'll go call them up to check. Basically, we are supposed to get $1.3k combined in GST credit + growth dividend, but we only got $750. recently, we got a flyer in the mail which shows how growth dividend (GD) and GST credit (GC) are allocated. we realised that we are allocated according to our former residences. now, we bought a flat and got married last year. we moved in early sept, and my wife changed her address last year, before we moved to our 3-room flat. i being a lazy bugger, and due to special circumstances, cannot change anyhow at NPP. so i did it this year. if they didn't know that i moved, fair enuff. but they didn't register my wife's new address. how strange, considering that they sent BOTH our GC+GD letter to our current address. btw, we are all allocated GC+GD based on our "Annual value of home as at 31 Dec 2007", according to the official flyer. THis is a caution to all who downgraded to check that they have not been shortchanged. for upgraders, u probably didn't stand to profit. if you did, i'm sure they will claim it back from you in the coming months, so you have been warned

- 8 replies

-

- Downgraded

- your

- (and 6 more)

-

The shell personal card gives 3% discount on top of whatever discount is given at the station. However, as far as I know the citibank dividend platinum card gives 5% rebate, but seems to come with a catch that you need to hit 10k of spending on the card in a 2 year time frame to get the rebate. If that the case, isnt the citibank dividend card a better deal? Did I miss something?

-

if you buy stocks and have it place in central depository , then it easy IRS will do everything BUT if you buy shares from broker or bank and get dividend .... if you dont declare you kena quite expensive upfront tax on the dividend something to the tune of 20 something percent BUT if you declare then you forever must declare any if accidentally miss one sometime later ...surely kena fine like crazy so in your case how do you manage this problem