Search the Community

Showing results for tags 'Bubble'.

-

Anyone knows? I am also looking at KOI and Gong Cha...wondering how much will be the franchise.

-

http://www.cbsnews.com/video/watch/?id=50142079n

-

Bloomberg-Singapore's Pop bubble Singapore

-

Hi all COE prices has been expanding upwards. I was wondering whether these prices are really sustainable. Will the bubble burst?

-

read this: http://www.businessinsider.com/there-are-n...-america-2010-9 and this: http://www.businessinsider.com/the-chinese...-dramatically-1 and see the resemblance in sgp?

-

Hi Bros, I'm going to Bangkok in 2 week time. Just wanna see you all can kai siao any nice place to visit bo?? Like for example, where got (1) place to buy car parts... and importantly (2) where got good place for bubble bath massage? Thank you

-

Source REPORT: Chevrolet nixes RHD Camaro It seems as if we've been waiting for the production Camaro for years (oh wait, we have). There are plenty of Camaro-loving Americans happy to see that Chevy's pony car is finally ready for prime time, but some overseas aficionados may be very disappointed. GM has reportedly canceled plans to produce a right-hand-drive Camaro due to the company's well-documented cash crunch. The General will still ship 100 LHD Camaros to the U.K., just enough to keep the muscle car from having to qualify for type-approval regulations. GM will also limit sales to the 422 hp V8 model, at a healthy price of

-

Noticed that the bubble tea craze is back again. Koi bubble tea lah, Gong Cha bubble tea lah.... anyway, still remembered 'pator' with my then girlfriend (now my wife :P ) and buy green apple bubble tea at Quickly... that was then.... 2001... fast forward to 2010... i don't seem to see any Quickly around. Went to their Taiwan website, they say Singapore got. But where ah? Anyone can tell me? Would like to go there and 're-live' those 'pator' years. Hahahaha....

-

Take It From Japan: Bubbles Hurt Yoshihisa Nakashima in front of his condominium building in the suburb of Kashiwa, far from his government job in Tokyo. His apartment is worth half of what he paid 14 years ago, during the real estate bubble. By MARTIN FACKLER Published: December 25, 2005 KASHIWA, Japan FOURTEEN years ago, Yoshihisa Nakashima looked at this sleepy suburb an hour and 20 minutes from downtown Tokyo and saw all the trappings of middle-class Japanese bliss: cherry-tree-lined roads, a cozy community where neighbors greeted one another in the morning and schools within easy walking distance for his two daughters. So Mr. Nakashima, a Tokyo city government employee who was then 36, took out a loan for almost the entire $400,000 price of a cramped four-bedroom apartment. With property values rising at double-digit rates, he would easily earn back the loan and then some when he decided to sell. Or so he thought. Not long after he bought the apartment, Japan's property market collapsed. Today, the apartment is worth half what he paid. He said he would like to move closer to the city but cannot: the sale price would not cover the $300,000 he still owes the bank. With housing prices in the United States looking wobbly after years of spectacular gains, it may be helpful to look at the last major economy to have a real estate bubble pop: Japan. What Americans see may scare them, but they may also learn ways to ease the pain. To be sure, there are several major differences between Japan in the 1980's and the United States today. One is the fact that property prices rose much faster and more steeply in Japan, partly because speculators used paper profits from a booming stock market to invest in property, insupportably leveraging the prices of both higher and higher. Another difference is that the biggest speculators in Japan's frenzy were deep-pocketed corporations, and they pumped up the commercial property market at the same time that home prices were inflating. Still, for anyone wondering why even the possibility of a housing bubble in the United States preoccupies so many economists, it is worth looking at how the property crash in Japan helped to flatten that economy, which is second only to that of the United States, and to keep it on the canvas for more than a decade. And as American homeowners contemplate what might happen if their property values fell -particularly if they fell hard - there are lessons in the bitter experiences of their Japanese counterparts like Mr. Nakashima. JAPAN suffered one of the biggest property market collapses in modern history. At the market's peak in 1991, all the land in Japan, a country the size of California, was worth about $18 trillion, or almost four times the value of all property in the United States at the time. Then came the crashes in both stocks and property, after the Japanese central bank moved too aggressively to raise interest rates. Both markets spiraled downward as investors sold stocks to cover losses in the land market, and vice versa, plunging prices into a 14-year trough, from which they are only now starting to recover. Now the land in Japan is worth less than half its 1991 peak, while property in the United States has more than tripled in value, to about $17 trillion. Homeowners were among the biggest victims of the Japanese real estate bubble. In Japan's six largest cities, residential prices dropped 64 percent from 1991 to last year. By most estimates, millions of homebuyers took substantial losses on the largest purchase of their lives. Their experiences contain many warnings. One is to shun the sort of temptations that appear in red-hot real estate markets, particularly the use of risky or exotic loans to borrow beyond one's means. Another is to avoid property that may be hard to unload when the market cools. Economists say Japan also contains lessons for United States policy makers, like Ben S. Bernanke, who is expected to become chairman of the Federal Reserve at the end of January. At the top of the list is to learn from the failure of Japan's central bank to slow the rise of the country's real estate and stock bubbles, and then its failure to soften their collapse. Only recently did Japan finally find ways to revive the real estate market, by using deregulation to spur new development. Most of all, economists say, Japan's experience teaches the need to be skeptical of that fundamental myth behind all asset bubbles: that prices will keep rising forever. Like their United States counterparts today, too many Japanese homebuyers overextended their debt, buying property that cost more than they could rationally afford because they assumed that values would only rise. When prices dropped, many buyers were financially battered or even wiped out. "The biggest lesson from Japan is not to fall into the same state of denial that existed here," said Yukio Noguchi, a finance professor at Waseda University in Tokyo who is perhaps the leading authority on the Japanese bubble. "During a bubble, people don't believe that prices will fall," he said. "This has been proven wrong so many times in the past. But there's something in human nature that makes us unable to learn from history." In the 1980's, Professor Noguchi said, the frenzy in Japan reached such extremes that companies tried to outbid one another even for land of little or no use. At the peak, an empty three-square-meter parcel (about 32 square feet) in a corner of the Ginza shopping district in Tokyo sold for $600,000, even though it was too small to build on. Plots only slightly larger gave birth to bizarre structures known as pencil buildings: tall, thin structures that often had just one small room per floor. As a result, Japan's property market in the 1980's was much more fragile than America's today, Professor Noguchi said. And when the market fell, it fell hard. Because of all the corporate speculation, the collapse wiped out company balance sheets, crippled the nation's banks and gave the overall economy a blow to the chin. Since 1991, Japan has spent 11 years sliding in and out of recession. It is only now showing meaningful signs of recovering, with the World Bank forecasting that Japan's economy will grow by a solid 2.2 percent this year Despite the differences, Professor Noguchi said he also saw parallels between Japan then and America now. Last year, as a visiting professor at Stanford, he said he read real estate articles in local newspapers that sounded eerily familiar. Houses were routinely selling for $10 million or more, he said, with buyers saying they felt that they had no choice but to buy now, before prices rose even further. "It was d

-

My civic comes with Vkool installed. Anyway I think there is an air bubble or water bubble on the windscreen on the inside of my car. It is not a scratch or chip in the glass as it feels smooth to touch and I cant clean it off. Is there anything I can do about it? The vkool brochure says any water bubbles will disappear in 4 to 10 weeks. I have my car for about 4 weeks now. Anyone has any experience on this? Anything I should do?

-

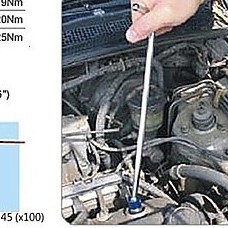

Have you ever come across such simple wheel balancer ? They were very popular right up to early 1980s.Some shops operated by very old uncles in Spore and Msia maybe still quietly using them to balance light truck tyres up to 16" dia. Cheap, good and fast - they are practically maintenance free.My third world countries customers still unconvinced that our shops once upon a time use such simple balancers to generate very good income.They want only computerised managed type with all the light and whistles without taking into consideration their very poor electrical supply that can fluctuate more than 20% and also thier road conditions which just do not permit high speed driving. Let us know if you do come across such antique in Singapore tyre shops

-

If I look closely at my paint, there are extremely small specks on the black paint.. It is kind of similar to the "chicken skin" you get when its cold, except much smaller. What can this mean? My car had a bad paint job? It is especially visible on the top of the car... Probably because of extensive sun? By the way, today I've tried the 4 steps system... wash -> clay -> cleaner -> polish ->wax The conclusion is.... 1. Buy a random orbital buffer. 2. Fixing paint chips will help the look of the car much better than cleaning the surface. 3. Buy micro fibre cloth.. Extremely good for picking up polish, wax, cleaner. 4. Meguairs Scratch X is excellant product... I rubbed it on one spot full of swirls, and I get a smooth scratchless spot. Good rubber, and designed such that you won't rub too much off.